-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

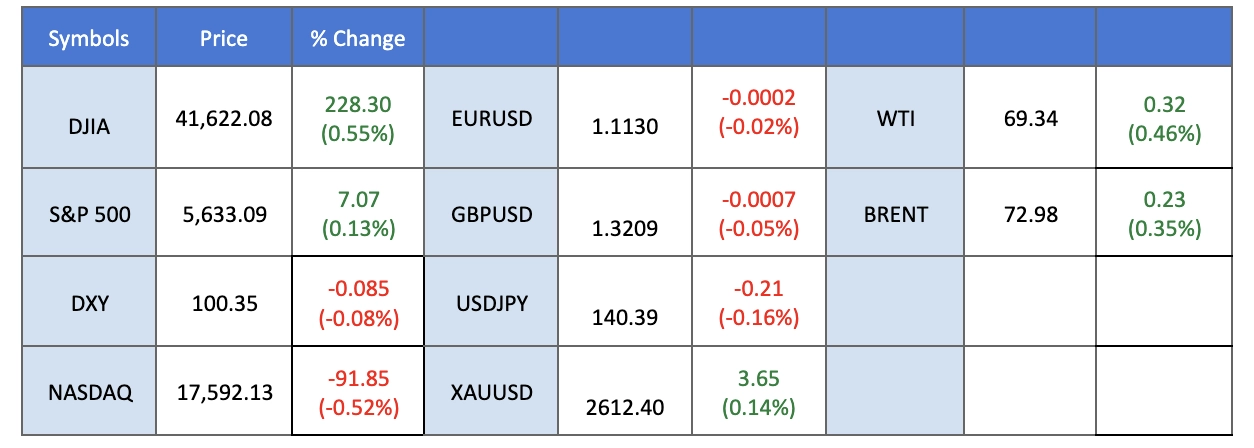

Market Summary

The US Dollar Index continues to extend its losses, hovering near strong support levels ahead of the Federal Reserve’s crucial monetary policy meeting this week. With market expectations leaning towards a rate cut, investors are closely watching the Fed’s decision, as nearly 41% anticipate a 50-basis-point reduction, according to the CME FedWatch Tool. Despite slightly higher-than-expected US inflation, uncertainty lingers around the dollar’s outlook.

In commodities, gold prices surged to record highs amid growing expectations for a larger Fed rate cut and heightened market volatility. Reports of a second assassination attempt on Republican presidential nominee Donald Trump have further fueled demand for safe-haven assets. Meanwhile, oil prices climbed as Hurricane Francine disrupted over 12% of crude production in the US Gulf of Mexico, countering weaker Chinese demand and offering support to the energy market.

The Dow Jones hit fresh record highs as investors anticipate a more aggressive Fed rate cut. Positive US economic data, including better-than-expected CPI and PPI figures, coupled with rising oil prices, have bolstered sentiment. In currency markets, the AUD/USD remains strong due to US dollar weakness, but pessimism over China’s economic outlook is dampening the Australian dollar. Meanwhile, GBP/USD and EUR/USD remain largely influenced by expectations surrounding central bank decisions this week.

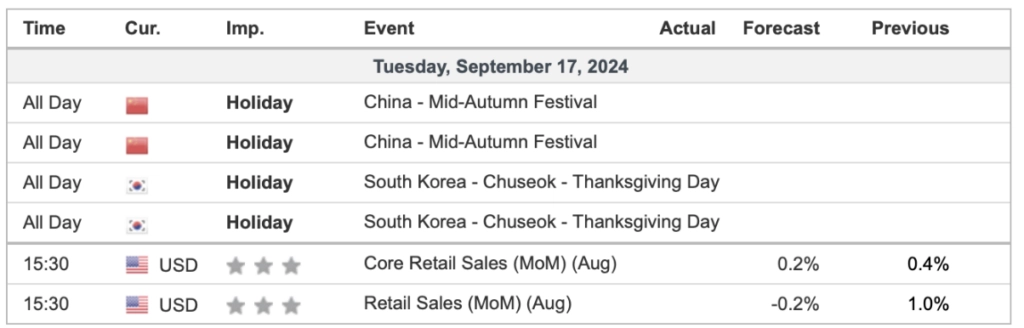

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (52%) VS -25 bps (48%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index continued to hover around strong support levels, with market participants in a wait-and-see mode ahead of the Federal Reserve’s two-day meeting. There are expectations for a rate cut, with 41% of the market anticipating a 50 basis points reduction, despite slightly higher-than-expected inflation. The outlook for the dollar remains uncertain, and investors are focusing on the Fed’s upcoming decisions.

The Dollar Index is seemingly facing strong resistance at the near $101.80 level. The RSI and the MACD suggest that the bullish momentum for the dollar has vanished. If the index falls below this level, it may be a bearish signal for the dollar.

Resistance level: 101.80, 102.35

Support level: 100.60, 99.70

Gold prices surged to record highs amid growing expectations that the Federal Reserve will implement a larger rate cut later this week. In a surprising turn, reports surfaced about a second assassination attempt on Republican presidential nominee Donald Trump, which further boosted demand for safe-haven assets like gold and the US dollar. Though Trump was unharmed during the attempt, the event has raised market volatility. With dovish sentiment prevailing and increased uncertainty ahead of the US elections, gold’s appeal remains robust.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 73, suggesting the commodity might enter overbought territory.

Resistance level: 2585.00, 2605.00

Support level: 2560.00, 2530.00

GBP/USD kicked off the week with a fresh bullish push, climbing back above the 1.3200 mark. Investor sentiment remains optimistic, anticipating significant developments from central banks this week, especially the Federal Reserve’s rate cut. Meanwhile, the Bank of England (BoE) is expected to deliver its own rate decision on Thursday, with the general expectation that it will maintain its current 5.0% rate.

GBP/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the pair might enter overbought territory.

Resistance level: 1.3220, 1.3280

Support level:1.3105, 1.3025

EUR/USD remains primarily influenced by US dollar weakness due to a lack of significant market drivers from the Eurozone. Investors will be closely watching key US data this week, particularly the US Retail Sales report and the Federal Reserve’s monetary policy decisions, to assess the future direction of the euro.

EUR/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the pair might enter overbought territory.

Resistance level: 1.1125, 1.1190

Support level: 1.1020, 1.0920

The Dow Jones hit fresh record highs as investors look to the equity markets, anticipating that the Fed might opt for a more aggressive rate cut this week. While the scale of the rate cut remains debated, overall US economic performance has not been as weak as expected, with slightly better-than-expected CPI and PPI data indicating that consumer spending is still robust. The oil and gas sector has also been buoyed by the recent rise in oil prices.

Dow Jones is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the index might enter overbought territory.

Resistance level: 41870.00, 42370.00

Support level: 41170.00, 40740.00

AUD/USD remains strong, supported by the consistent depreciation of the US dollar. However, concerns over China’s economic outlook have introduced uncertainty for the Australian dollar, which is often considered a proxy for Chinese economic performance. Analysts warn that weak Chinese data suggests significant challenges for the world’s second-largest economy. Given that China is a key trading partner for Australia, any downturn in China’s economy could have a material impact on the Australian market.

AUD/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 0.6750, 0.6795

Support level: 0.6675, 0.6625

The Chinese economy outlook remains pessimistic, weighed on overall equity performance.s Economists from Goldman Sachs and Citi have revised their 2024 GDP growth forecasts for China down to 4.7%, below Beijing’s target of around 5.0%. Société Générale has described China’s economic outlook as a “downward spiral,” while Barclays referred to it as “from bad to worse” and a “vicious cycle.” Morgan Stanley added that “things could get worse before they get better,” reinforcing the bearish sentiment for China’s equity market.

HK50 is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 18200.00, 19340.00

Support level: 17205.00, 16270.00

Oil prices climbed on concerns about potential supply disruptions. The aftermath of Hurricane Francine continues to impact production in the US Gulf of Mexico, offsetting weaker demand from China ahead of the Fed’s interest rate decision. More than 12% of crude production and 16% of natural gas output in the Gulf remain offline. Additionally, expectations of US rate cuts have weighed on the dollar, supporting dollar-denominated oil prices further.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 71.95, 74.15

Support level: 69.90, 67.55

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!