-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

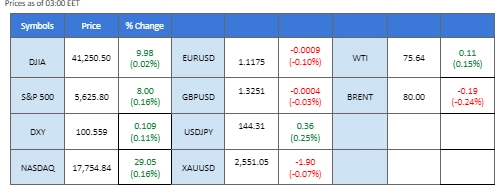

Market Summary

As the market searches for direction, most asset classes remained relatively flat in the last session, with investors waiting for a catalyst to drive momentum. On Wall Street, attention turns to Nvidia’s earnings report, due later today. Expectations are high for strong earnings performance, which could potentially lift major indexes if results exceed forecasts.

In the forex market, the U.S. dollar traded sideways, finding support above the $100.50 level, as traders anticipate Thursday’s U.S. GDP data, which could influence the dollar’s direction. Meanwhile, the Australian dollar surged to its highest level in 2024 against the subdued U.S. dollar after the Australian inflation reading exceeded market expectations, bolstering the Aussie. Additionally, the BoJ Deputy Governor is set to speak, with market participants looking for insights into the BoJ’s upcoming monetary policy moves.

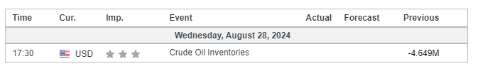

In the commodities market, gold is facing significant selling pressure near its all-time high region above the $2,525 level, suggesting resistance at this critical zone. Oil prices experienced a technical retracement in the last session, with traders closely watching today’s U.S. weekly crude inventories data for further cues.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the dollar against a basket of six major currencies, extended its losses after a brief gain in the previous session, as investors remain cautious ahead of key economic reports due later this week. The overall long-term trend for the dollar still leans toward a bearish bias, driven by expectations of a rate cut in September. However, traders should remain vigilant, as better-than-expected US economic data, particularly the US Core PCE Price Index, could trigger a significant rebound in the dollar. As such, it is crucial for traders to closely monitor upcoming US economic data for further trading signals.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI isd at 17, suggesting the index might enter oversold territory.

Resistance level: 102.35, 103.35

Support level: 100.55, 99.70

Gold prices are trading higher, supported by escalating geopolitical tensions in the Middle East and expectations of rate cuts from the Federal Reserve. Fed Chair Jerome Powell’s recent speech at the Jackson Hole symposium signalled that “the time has come” to begin lowering interest rates, bolstering the appeal of gold as a non-interest-bearing asset. Investors are now looking for further cues from upcoming speeches by Fed officials Christopher Waller and Raphael Bostic on Wednesday to gauge the US interest rate path. However, uncertainties persist ahead of several crucial reports, including GDP data and the US Core PCE Price Index, which investors should monitor for additional trading signals.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the commodity might extend its loose since the RSI retreated sharply from overbought territory.

Resistance level: 2520.00, 2535.00

Support level: 2505.00, 2480.00

The GBP/USD pair edged higher after consolidating in the last session, indicating a bullish bias. With both the U.S. dollar and the British pound currently lacking strong catalysts, traders are focusing on tomorrow’s U.S. GDP data and Friday’s PCE reading. These key economic indicators could significantly impact the pair’s price movement, providing fresh direction for traders.

GBP/USD is trading in an uptrend, and the pair has soared to its highest level since March 2022. The RSI has been flowing within the overbought zone since the beginning of the week, while the MACD has been moving upward, suggesting that the bullish momentum is extremely strong.

Resistance level: 1.3280, 1.3350

Support level: 1.3140, 1.3065

The EUR/USD pair is trading sideways again after breaking out of its previous consolidation range. The market remains relatively quiet as traders await Friday’s inflation data from both the Eurozone and the U.S. This data release is expected to bring higher price volatility, potentially setting a new direction for the pair depending on the outcomes.

Despite the pair trading within its uptrend trajectory, the bullish momentum with the pair is seemingly softening. The RSI has dropped out from the overbought zone while the MACD has formed a bearish divergence, suggesting a potential trend reversal for the pair.

Resistance level: 1.1230, 1.1290

Support level: 1.1106, 1.1045

The AUD/USD pair edged slightly higher during Wednesday’s Sydney session following the release of Australia’s Weighted Mean CPI reading, which exceeded market expectations. This suggests that inflationary pressures in the country remain persistent. Meanwhile, Aussie traders are closely watching Friday’s Australian Retail Sales data, which could further bolster the strength of the Australian dollar.

The pair is breaking above its current price consolidation range, suggesting a bullish bias. The RSI has been maintaining above the 50 level, suggesting a bullish signal, while the MACD has formed a lower high, suggesting the bullish momentum is easing.

Resistance level: 0.6845, 0.6921

Support level: 0.6730, 0.6670

Bitcoin, and the broader cryptocurrency market, experienced a sharp decline following statements from Donald Trump that could strain the relationship between the US and China concerning cryptocurrency collaboration. Beijing-based Bitmain Technologies Ltd., which holds a 90% share of the market for Bitcoin mining computers, could face unprecedented challenges if Trump, who has expressed a desire for Bitcoin to be “mined, minted, and made” in the US, returns to the White House. Rising political tensions and the possibility of stricter regulations could dampen investor sentiment toward the crypto market.

BTC/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 19, suggesting the crypto might enter oversold territory.

Resistance level: 60535.00, 62735.00

Support level: 58340.00, 55625.00

The USD/JPY pair has eased from its bearish trend after the BoJ Core CPI reading released yesterday came in lower than market expectations, leading to a weakening of the Japanese Yen. However, traders are now focused on the BoJ Deputy Governor’s scheduled speech today, which could provide insights into the Japanese central bank’s upcoming monetary policy moves. A hawkish statement from the BoJ official could strengthen the Yen and push the pair lower.

The pair remains trading within its downtrend channel, suggesting a bearish bias. The RSI has been flowing below the 50 level, while the MACD has been hovering flat below the zero line, suggesting the pair remains trading with bearish momentum.

Resistance level: 146.00, 149.20

Support level: 143.45, 141.40

Crude oil prices tumbled as major analysts, including Goldman Sachs, predicted that the disruptions in Libya would be short-lived, with 600,000 barrels per day (bpd) falling off the market in September and 200,000 bpd in October. Goldman Sachs also significantly cut its oil price forecast, citing a weakening global economic outlook, particularly in China, and the rising adoption of electric vehicles as factors likely to dampen oil demand

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 76.75, 80.90

Support level: 72.50, 67.50

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!