-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

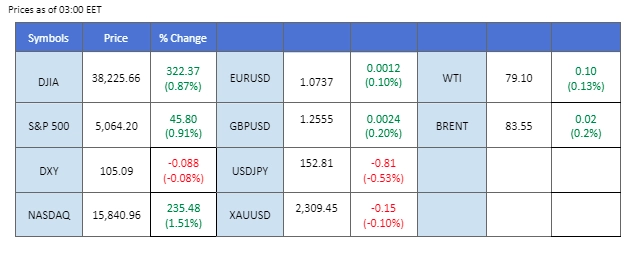

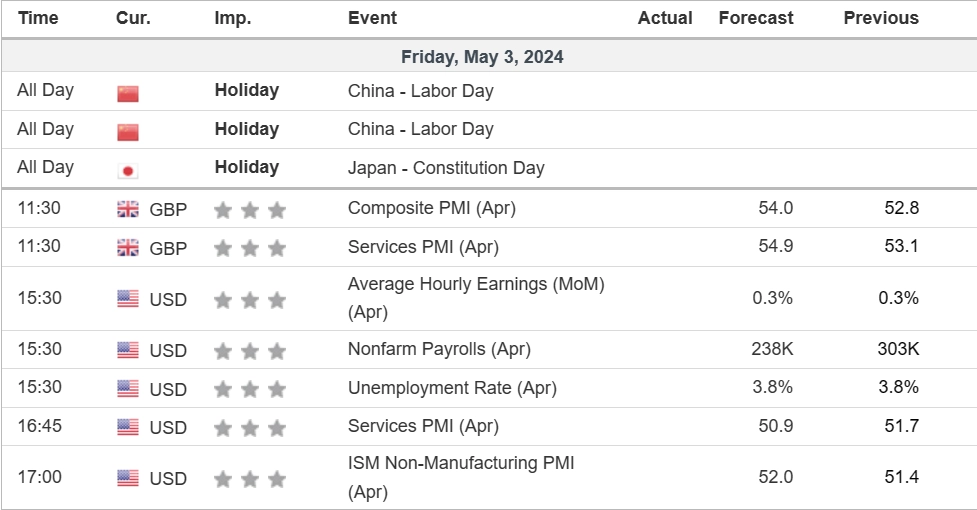

Following Jerome Powell’s remarks subsequent to the Fed’s interest rate decision announcement, equity markets rallied in response to the dovish tone from the Fed chief, while the Dollar index continued its decline. The Fed’s dismissal of another rate hike possibility, despite persistent inflation in the U.S., contributed to the Dollar’s weakening. Market attention now shifts to today’s U.S. NFP reading, which could provide insights into the Fed’s forthcoming monetary policy decisions.

Sur le marché des matières premières, les prix d'actifs tels que l'or et le pétrole sont restés modérés, principalement en raison de l'évolution positive des tensions au Moyen-Orient. Les prix du pétrole, en particulier, ont été affectés par une augmentation importante des stocks de brut aux États-Unis et par des résultats économiques médiocres en Chine.

Sur le marché des changes, les principales devises, y compris la livre sterling et l'euro, ont progressé par rapport au dollar américain avant la publication des résultats du NFP. Cependant, le yen japonais a surperformé, atteignant son plus haut niveau en trois semaines sur fond de suspicion d'intervention de la part des autorités japonaises. Les participants au marché attendent avec impatience les commentaires du ministre japonais des finances et du gouverneur de la BoJ, qui doivent tous deux tenir une conférence de presse à Tbilissi en marge de la 57e réunion de la Banque asiatique de développement.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 12 juin Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (88.2%) VS -25 bps (11.8%)

(Heure du système MT4)

Source : MQL5

The Dollar Index, which tracks the greenback against a basket of major currencies, extends its losses following the Federal Reserve’s interest rate decision. Investors grapple with the implications of the Fed’s perceived dovish stance, prompting profit-taking ahead of key economic events. With attention shifting back to economic data releases, market focus centres on deciphering signals regarding future monetary policy directions. Anticipation builds for upcoming reports, including Nonfarm Payrolls and the Unemployment Rate, which are poised to provide critical insights into market sentiment.

L'indice du dollar se négocie à la baisse tout en testant actuellement le niveau de support. Le MACD a illustré une dynamique baissière croissante, tandis que le RSI est à 35, suggérant que l'indice pourrait étendre ses pertes après la rupture puisque le RSI reste en dessous de la ligne médiane.

Niveau de résistance : 105,70, 106,35

Niveau de support : 105.20, 104.60

Gold prices remain stable and trade flat amid mixed market sentiment, with investors awaiting key economic data releases. Despite a recent depreciation of the US Dollar fueled by dovish remarks from Federal Reserve members, gold’s losses are limited amidst easing tensions in the Middle East. Market participants closely monitor major events, including the release of crucial jobs reports and ongoing negotiations in the Middle East, for indications of market direction and trading opportunities.

Le prix de l'or est en baisse et teste actuellement le niveau de support. Le MACD a illustré une dynamique baissière croissante, tandis que le RSI est à 45, suggérant que la marchandise pourrait étendre ses pertes après la rupture puisque le RSI reste en dessous de la ligne médiane.

Niveau de résistance : 2330,00, 2360,00

Niveau de support : 2300.00, 2270.00

The GBP/USD pair continues its upward trajectory, currently encountering short-term resistance at the 1.2560 level. The rally was primarily driven by the dovish comments from Fed Chair Jerome Powell last Wednesday, indicating that another rate hike from the Fed is less likely despite persistent inflation in the U.S. Market focus now shifts to today’s Non-Farm Payroll (NFP) data, which is anticipated to offer further insights into the Fed’s upcoming monetary policy decisions.

La paire GBP/USD s'est consolidée après avoir quitté le canal haussier, suggérant que la tendance haussière se maintient. Le RSI est au-dessus du niveau de 50, tandis que le MACD n'est pas tombé en dessous de la ligne de zéro, ce qui suggère que la paire continue à se négocier avec une dynamique haussière.

Niveau de résistance : 1,2660, 1,2760

Niveau de support : 1.2440, 1.2370

The EUR/USD pair has rallied, now testing its short-term resistance at the 1.0740 level. The euro initially weakened following a lower-than-expected CPI reading, which is edging closer to the ECB’s target rate of 2%. However, the currency found support from the dovish stance taken by the Federal Reserve following its latest interest rate decision announcement. Moving forward, the pair’s trajectory is expected to be significantly influenced by today’s U.S. Non-Farm Payroll (NFP) data, which could provide critical insights into the Fed’s future monetary policy actions.

La paire teste actuellement son niveau de résistance à court terme à 1,0740 avec une dynamique haussière suffisante. Le RSI se déplace progressivement vers le haut, tandis que le MACD montre des signes de rebond au-dessus de la ligne de zéro, ce qui suggère que la paire continue à se négocier avec une dynamique haussière.

Niveau de résistance : 1,0775, 1,0865

Niveau de support : 1.0700, 1.0630

The Hang Seng Index has exhibited strong bullish momentum over the past two weeks, surging by nearly 15%. This remarkable rally has been fueled by several factors, including the dovish stance adopted by the Federal Reserve, which has boosted risk appetite across the board. Additionally, the Chinese government’s monetary easing policies have played a significant role in attracting capital inflows into the Hang Seng Market. These policies have effectively bolstered investor confidence, propelling the index to reach its highest level in 2024.

L'indice HSI a franchi son deuxième niveau de résistance psychologique à 18000 et continue de grimper, ce qui suggère une forte dynamique haussière. Le RSI et le MACD sont tous deux à la hausse, ce qui suggère que l'indice évolue dans une dynamique haussière extrême.

Niveau de résistance : 19340.00, 20650.00

Niveau de support : 18190.00, 17210.00

The Japanese yen gained significant bullish momentum in early Asian trading hours, with market participants speculating on potential intervention by the Bank of Japan (BOJ). The BOJ and Japanese Finance Minister have reiterated their commitment to monitoring currency movements closely, suggesting possible intervention if the yen’s stability is compromised. The currency’s upward trajectory reflects ongoing concerns about its strength and underscores heightened vigilance among investors.

La paire USD/JPY se négocie à la baisse suite à la cassure précédente sous le niveau de support précédent. Le MACD a illustré une dynamique baissière croissante, tandis que le RSI est à 46, suggérant que la paire pourrait étendre ses pertes vers le niveau de support puisque le RSI reste en dessous de la ligne médiane.

Niveau de résistance : 154,70, 158,45

Niveau de support:151.70, 149.40

Les prix du pétrole brut connaissent une baisse significative, testant les niveaux de soutien dans le contexte des négociations de cessez-le-feu en cours au Moyen-Orient et des augmentations inattendues des données sur les stocks. La possibilité d'un accord de cessez-le-feu, associée à des niveaux de production plus élevés que prévu, augmente la pression sur les prix du pétrole, signalant un sentiment baissier sur le marché. Les investisseurs surveillent de près l'évolution de la situation au Moyen-Orient et la dynamique des stocks pour déceler d'éventuels changements dans la dynamique du marché pétrolier et les signaux de négociation.

Les prix du pétrole se négocient à la baisse suite à la cassure précédente en dessous du niveau de support précédent. Cependant, le MACD a montré une diminution de la dynamique baissière, tandis que le RSI est à 34, ce qui suggère que le produit de base pourrait entrer en territoire survendu.

Niveau de résistance : 80,45, 81,90

Niveau de support : 78.00, 75.95

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !