-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

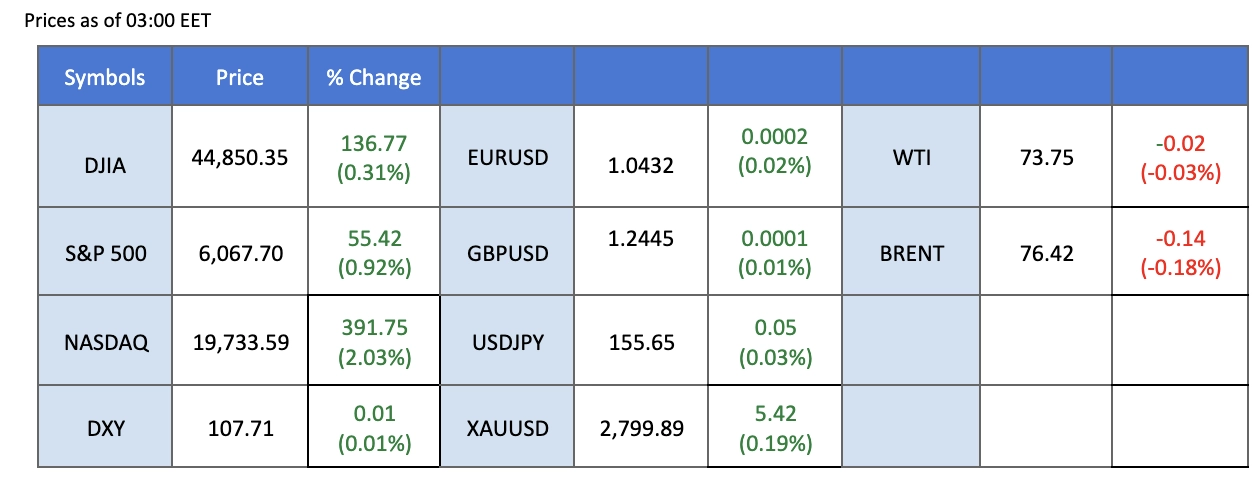

Synthèse du marché

The U.S. dollar remained firm ahead of key central bank decisions, with USD/CAD edging higher as traders anticipated a rate cut from the Bank of Canada. Meanwhile, market sentiment stayed cautious ahead of the Federal Reserve’s policy meeting, with investors closely watching for any signals on future rate changes. Gold rebounded after recent sell-offs, with its trajectory tied to the Fed’s outlook and safe-haven demand.

Oil prices remained steady in Asian trading after U.S. crude inventory data showed a smaller-than-expected build, but concerns over weak Chinese economic data and ongoing trade risks kept prices under pressure. Meanwhile, the Australian dollar extended its losses for the third consecutive day as weak inflation data reinforced expectations of a February rate cut by the RBA, adding downside risks to AUD/USD.

Bitcoin held above the $100K mark, supported by dip-buying and optimism over potential crypto-friendly regulations. In the stock market, U.S. equities rebounded, led by Nvidia’s recovery after suffering a historic selloff. Despite the rebound, volatility remains high as investors assess the impact of DeepSeek AI on tech giants and broader market conditions.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 29 janvier Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (97.3%) VS -25 bps (2.7%)

Aperçu du marché

Calendrier économique

(Heure du système MT4)

Source : MQL5

Mouvements du marché

INDICE_DOLLAR, H4

Major markets remained muted ahead of the Federal Reserve’s two-day policy meeting, set to conclude on Wednesday. While the Fed is widely expected to maintain its current stance, investors are closely monitoring its statement for insights on future policy direction. Former President Trump’s repeated calls for rate cuts have added uncertainty to the outlook, keeping traders on edge. The Dollar Index remained flat as investors adopted a wait-and-see approach.

The Dollar Index is trading flat while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 52, suggesting the index might consolidate in a zone since the RSI near the midline.

Resistance level: 107.95, 109.00

Niveau de support : 106.80, 105.75

Gold prices recovered as market sentiment stabilized, prompting investors to rebuild positions after a recent sell-off. The decline had been driven by institutional liquidations to cover margin calls following DeepSeek AI’s impact on Wall Street, which triggered a sharp Nasdaq selloff. Moving forward, gold’s trajectory remains tied to the Fed’s policy outlook, with monetary policy expectations playing a key role in shaping safe-haven demand.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the commodity might enter overbought territory.

Resistance level: 2765.00, 2785.00

Niveau de support : 2740.00, 2720.00

USD/CAD edged higher as demand for the U.S. dollar remained firm ahead of key central bank decisions. While the Fed is expected to hold rates steady, traders are watching for any signals on future policy shifts, especially as Trump continues to push for immediate rate cuts. Meanwhile, the Bank of Canada is anticipated to cut rates by 25 basis points to 3.0%, which could weigh on the Canadian dollar.

USD/CAD is trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 54, suggesting the pair might consolidate since the RSI near the midline.

Resistance level: 1.4450, 1.4525

Support level: 1.4305, 1.4190

The Australian dollar extended its losing streak for the third straight day, hitting a one-week low after softer-than-expected inflation data reinforced expectations of a February rate cut by the Reserve Bank of Australia (RBA). The Consumer Price Index (CPI) rose by just 0.20%, missing the 0.30% forecast. Additionally, renewed concerns over China’s economic outlook and trade tensions with the U.S. further dampened sentiment, increasing downside risks for AUD/USD ahead of the FOMC decision.

AUD/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated diminishing bullish momentum, while RSI is at 37, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 0.6525, 0.6290

Support level: 0.6200, 0.6145

U.S. stocks closed higher on Tuesday, led by a recovery in Nvidia and other AI-linked tech shares. The Nasdaq outperformed as Nvidia rebounded after suffering a record $593 billion single-day market value loss on Monday—the largest in history. Despite the recovery, market volatility remains elevated as investors digest DeepSeek AI’s competitive threat to U.S. tech giants.

Nasdaq is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 21820.00, 22140.00

Support level: 21255.00, 20765.00

Oil prices stabilized in Asian trade on Wednesday after industry data showed a smaller-than-expected build in U.S. crude inventories. The American Petroleum Institute reported a 2.86-million-barrel increase last week, below market expectations of 3.7 million barrels. However, concerns over weak Chinese economic data and President Trump’s trade tariff plans continue to weigh on sentiment, keeping crude prices under pressure.

Crude oil is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 45, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Niveau de résistance : 74,65, 76,85

Niveau de support : 72.50, 69.85

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !