-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

Synthèse du marché

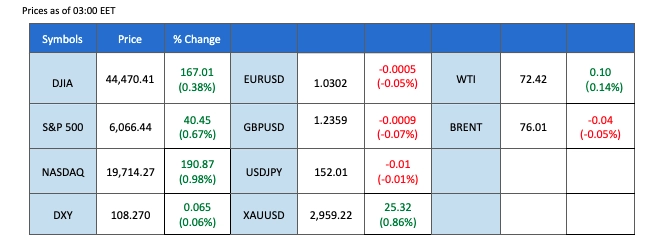

Gold prices soared to record highs as U.S. President Donald Trump’s announcement of fresh steel and aluminum tariffs fueled trade war concerns. The 25% tariffs, set to take effect on March 4, targeted major exporters, including Canada, Mexico, and Germany, driving investors toward safe-haven assets. Meanwhile, the U.S. dollar defied trade uncertainty, strengthening as markets speculated that higher tariffs could provide short-term economic support despite rising inflation risks.

The euro remained under pressure as investors reacted to Trump’s tariffs on European steel and aluminum exports. Germany, a key exporter, faced added economic pressure, with potential for further trade restrictions exacerbating downside risks. Crude oil rebounded nearly 2% following a three-week decline, driven by bargain buying and technical corrections, though trade war fears continue to cloud the long-term outlook.

U.S. equity markets remained in consolidation as inflation and trade concerns limited upside momentum. Investors are now focused on upcoming U.S. inflation data and Fed Chair Powell’s speech, which could provide further clarity on the Federal Reserve’s policy direction. Meanwhile, Bitcoin remained in a consolidation phase, with market sentiment mixed amid speculation over Trump’s potential pro-crypto stance but lacking concrete policy details.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 19 mars Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (91.50%) VS -25 bps (8.5%)

Aperçu du marché

Calendrier économique

(Heure du système MT4)

Source : MQL5

Mouvements du marché

The Dollar Index (DXY) strengthened, defying trade concerns, as investors speculated that higher tariffs could provide short-term support for the U.S. economy. However, inflation risks are mounting, with markets expecting the Federal Reserve to keep rates elevated to counter potential price pressures. Key focus now shifts to U.S. CPI data on Wednesday and Fed Chair Powell’s speech, which could provide further insight into the Fed’s next policy moves.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 108.35, 109.90

Support level: 107.35, 106.50

Gold prices surged to new record highs after U.S. President Donald Trump announced fresh tariffs on steel and aluminum imports, escalating trade war fears. The 25% tariffs, set to take effect on March 4, will hit major exporters like Canada, Mexico, Germany, and several Asian nations. Trump also hinted at reciprocal tariffs, further intensifying concerns over global trade disruptions.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 76, suggesting the commodity might enter overbought territory.

Resistance level: 2960.00, 3000.00

Support level: 2820.00, 2775.00

The British pound (GBP) fell further, as the strengthening U.S. dollar and ongoing trade concerns led investors to sell higher-risk currency pairs. Additionally, the Bank of England’s (BoE) dovish policy outlook for 2025 has further dampened demand for the pound. Moving forward, key UK economic data, including GDP reports, will be closely watched for further market direction.

GBP/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.2385, 1.2485

Support level: 1.2275, 1.2170

The euro extended its losses as investors braced for new U.S. tariffs on European steel and aluminum exports. On Monday, Trump signed an order imposing 25% tariffs on steel and aluminum imports, adding economic pressure on Germany, a major aluminum exporter to the U.S.. The threat of additional tariffs on European goods has weighed on market sentiment, keeping the euro under pressure against the dollar.

EUR/USD is training lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.0340, 1.0445

Support level: 1.0270, 1.0195

The Japanese yen pulled back from a two-month high, as some market participants took profits following a recent rally. The yen had gained support from hawkish expectations from the Bank of Japan (BoJ) and higher-than-expected Japanese inflation data. However, uncertainties surrounding Trump’s tariff policies and U.S. inflation prompted investors to shift to a wait-and-see approach.

USD/JPY is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 42, suggesting the pair might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 152.70, 154.10

Support level: 151.00, 149.30

The U.S. equity market remained in a consolidation phase, as tariff concerns and inflation fears limited upside momentum. Risk appetite weakened after Trump’s reciprocal tariff threats raised concerns over rising trade barriers. Key focus now turns to U.S. inflation data on Wednesday and Powell’s testimony, with Core CPI expected to rise 0.3% in January from 0.2% in December.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 57, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 21920.00, 22600.00

Support level: 21065.00, 20590.00

Bitcoin (BTC/USD) remains in a consolidation phase, struggling to find clear direction amid mixed market sentiment. Speculation about Trump’s potential pro-crypto policies has provided some long-term optimism, but the lack of concrete implementation details has frustrated traders. With Trump currently focused on trade tariffs, crypto investors may remain cautious in the short term.

BTC/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the crypto might extend its gains since the RSI stays above the midline.

Resistance level: 100455.00, 107850.00

Support level: 95560.00, 91110.00

Crude oil prices climbed nearly 2% on Monday, rebounding from a three-week losing streak amid bargain buying and a technical correction. However, the long-term outlook remains uncertain as trade war concerns and Trump’s tariff policies continue to weigh on market sentiment.

Crude oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 72.70, 75.05

Support level: 70.45, 68.45

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !