-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

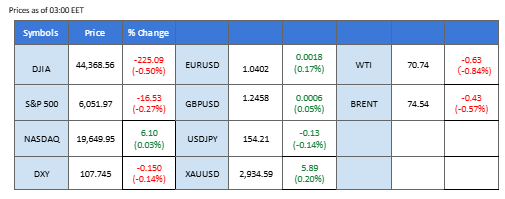

Synthèse du marché

Investors remained focused on the U.S. CPI data after Federal Reserve Chair Jerome Powell reinforced a hawkish outlook in his testimony on Tuesday, emphasizing the central bank’s commitment to maintaining restrictive monetary policy amid strong economic performance. The dollar initially strengthened as inflation came in at 3%, prompting Powell to reiterate that the Fed still has work to do in curbing inflationary pressures.

However, the greenback later eased as market sentiment shifted toward geopolitical developments. Former President Donald Trump urged Russian President Vladimir Putin to negotiate an end to the Russia-Ukraine conflict, fueling optimism for a potential resolution. The prospect of de-escalation supported the euro and Pound Sterling, while oil prices erased early-week gains, sliding nearly 3% on reduced geopolitical risk.

Looking ahead, traders will turn their attention to the UK GDP report, which could influence the direction of the Pound Sterling amid its recent lack of momentum. Meanwhile, Bitcoin (BTC) and Ethereum (ETH) found support after hitting new weekly lows, staging a technical rebound in the previous session.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 19 mars Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (91.50%) VS -25 bps (8.5%)

Aperçu du marché

Calendrier économique

(Heure du système MT4)

Source : MQL5

Mouvements du marché

The release of crucial US Consumer Price Index (CPI) data kept markets on edge. According to the US Bureau of Labor Statistics, the annual CPI came in at 3.0%, surpassing economists’ expectations of 2.9%. The dollar index initially surged following the hotter-than-expected CPI report but later retreated as investors engaged in profit-taking ahead of market uncertainties. This week, Trump approved 25% tariffs on steel and aluminum imports and hinted at reciprocal tariffs against key US trading partners, adding further uncertainty to the US economic outlook.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 43 suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 108.40, 109.90

Support level: 107.35, 106.50

Gold prices held near record highs as traders balanced hot US inflation data against rising safe-haven demand amid escalating trade tensions. Initially, gold dipped following the CPI release, as traders priced in fewer Fed rate cuts. However, uncertainty surrounding Trump’s aggressive tariff plans continued to fuel demand for the precious metal.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 61, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2935.00, 2960.00

Support level: 2875.00, 2815.00

The GBP/USD pair initially faced downward pressure after U.S. inflation data came in hotter than expected, strengthening the dollar. However, sentiment shifted following reports that former President Donald Trump urged Russian President Vladimir Putin to take steps toward resolving the prolonged conflict in Ukraine. The prospect of de-escalation in the region buoyed market confidence, providing support for the Pound Sterling. Looking ahead, traders are eyeing the UK GDP release today, which could have a direct impact on the currency pair.

GBP/USD remains flirting at its weekly high after the pair dipped and recovered in yesterday’s session. This suggests the pair has strong support below the 1.2430 mark. Both the RSI and MACD have been hovering in the middle region, suggesting a neutral signal for the pair.

Resistance level: 1.2610, 1.2730

Support level: 1.2375, 1.2300

EUR/USD has broken above its long-term downtrend resistance, signaling a potential shift in momentum. If the pair sustains levels above this threshold, it could confirm a bullish breakout. The euro gained traction after former President Donald Trump, acting as a mediator for Ukraine, reportedly urged Russian President Vladimir Putin to engage in talks to end the prolonged conflict. Hopes of geopolitical de-escalation have bolstered market sentiment, supporting the single currency.

EUR/USD has surged past the downtrend resistance level, suggesting a bullish bias for the pair. The RSI continues to climb while the MACD is poised to break above the zero line, suggesting that bullish momentum may be forming.

Resistance level: 1.0460, 1.0595

Support level: 1.0353, 1.0260

The USD/JPY pair has surged toward the key 154.00 level, where strong resistance may limit further upside. Market sentiment toward the yen shifted after Japan’s Producer Price Index (PPI) hit its highest level since July 2023, exceeding 4%. The strong inflation print reinforced speculation that the Bank of Japan (BoJ) may raise rates in March, a move that could strengthen the yen in the near term.

USD/JPY has gained nearly 2% since early this week, suggesting a bullish trend reversal for the pair. The RSI has gotten into the overbought zone, while the MACD has broken above from the zero line, suggesting that the pair is now trading with bullish momentum.

Resistance level: 156.25, 158.14

Support level: 152.00, 149.30

The Nasdaq ended the session unchanged as mixed market signals kept US equities struggling for clear direction. On the bearish side, stronger-than-expected US CPI data pushed Treasury yields higher, pressuring the broader equity market. However, optimism surrounding tech sector growth and AI advancements provided a cushion, helping the Nasdaq hold steady despite broader market uncertainty.

Nasdaq is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI retreated from overbought territory, suggesting the index might tilt toward a more bearish front and extend its consolidation trend.

Resistance level: 21920.00, 22590.00

Support level: 21065.00, 20590.00

Bitcoin (BTC) staged a strong recovery, rebounding over 3.5% after performing a liquidity grab near the $94,200 mark, where a significant number of long contracts were liquidated in the last session. The sharp bounce suggests a potential trend reversal, with BTC reclaiming previous highs. The broader risk sentiment improved after President Trump took the initiative to resolve the prolonged conflict in Eastern Europe, easing geopolitical tensions and boosting demand for risk assets, including cryptocurrencies.

BTC remains sideways and is trading in wide-ranging levels, which gives a neutral signal for BTC. However, the RSI has been flirting with the 50 level while the MACD is about to break above the zero line, suggesting that the bearish momentum is vanishing and that it may perform a technical rebound.

Resistance level: 99920.00, 103160.00

Support level: 96400.00, 92160.00

Crude oil prices fell slightly, pressured by a higher-than-expected US EIA inventory report. According to the Energy Information Administration (EIA), US crude oil inventories rose by 4.07M barrels, exceeding market expectations of 2.4M barrels, signaling weak demand. Meanwhile, Trump stated he would push for a ceasefire deal between Russia and Ukraine, potentially reducing supply disruptions and further pressuring oil prices.

Crude oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 73.30, 75.25

Support level: 70.40, 67.80

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !