-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

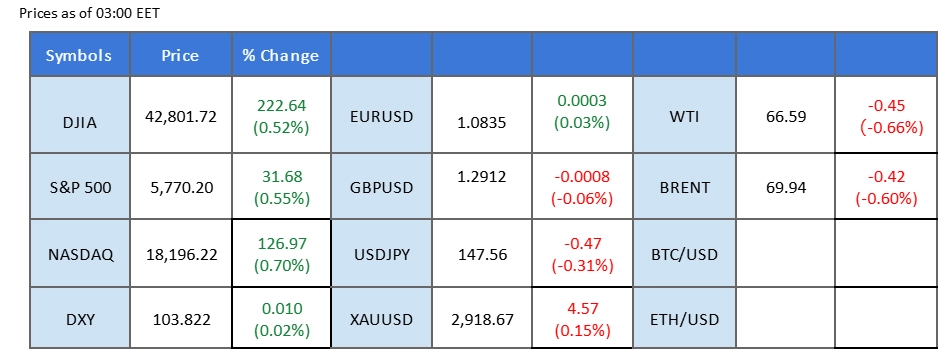

Synthèse du marché

The U.S. dollar weakened to a four-month low after Friday’s Nonfarm Payrolls (NFP) report came in below market expectations, while the unemployment rate ticked higher, signaling slower economic growth. The data, coupled with Trump’s aggressive trade policies, has heightened concerns over economic uncertainty, putting further pressure on Wall Street, where risk appetite remains subdued.

Amid risk-off sentiment, the Japanese yen surged, with USD/JPY falling to its lowest level since last October as markets anticipate another rate hike from the Bank of Japan next week. Similarly, gold remains firm above the $2,900 mark, benefiting from investors’ shift toward safe-haven assets.

Meanwhile, oil prices slumped to their lowest levels since last October, weighed down by weak U.S. jobs data, softer-than-expected Chinese CPI figures, and deteriorating global demand outlooks. The Trump administration’s trade policies, which risk escalating a trade war, have further exacerbated concerns over oil demand.

In the crypto market, sentiment deteriorated despite President Trump signing an executive order to establish a U.S. crypto strategic reserve stockpile. Market participants were disappointed that the government will not acquire cryptocurrencies from the open market but instead rely solely on forfeited digital assets to build the reserve, leading to broad-based selling pressure across the sector.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 19 mars Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (95%) VS -25 bps (5%)

Aperçu du marché

Calendrier économique

(Heure du système MT4)

N/A

Source : MQL5

Mouvements du marché

The Dollar Index extended its losses as a series of disappointing U.S. economic reports weighed on sentiment. Nonfarm Payrolls (NFP) dropped to 151K, missing expectations of 159K, while the unemployment rate edged up to 4.1%, surpassing the forecasted 4.0%. Ongoing uncertainty over President Donald Trump’s trade policies added to concerns, with Atlanta Fed President Raphael Bostic cautioning that these policies could cloud the U.S. economic outlook. Investors remained on edge as trade disputes and signs of an economic slowdown loomed.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 105.65, 107.60

Support level: 103.65, 101.70

Gold prices rebounded as ongoing economic and geopolitical uncertainties fueled demand for safe-haven assets. The weak U.S. jobs report raised concerns about the economy’s trajectory, further pressuring the dollar and boosting gold’s appeal. Additionally, Bitcoin’s sharp decline and persistent worries over Trump’s tariff policies prompted investors to seek stability in gold.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated flat momentum, while RSI is at 49, suggesting the commodity might consolidate since the RSI near the midline.

Resistance level: 2925.00, 2950.00

Support level: 2900.00, 2860.00

The GBP/USD pair has maintained a bullish bias, though momentum has eased, leading to a narrow trading range. With the Pound Sterling lacking a clear catalyst, the pair’s movement has been primarily dictated by U.S. dollar dynamics. The dollar remains under pressure following weaker-than-expected U.S. job data released last Friday, which has fueled concerns over slowing economic growth. This has allowed GBP/USD to hover near its recent highs, as traders assess whether further upside is warranted amid broader market uncertainty.

The pair is seemingly lacking a catalyst after climbing by more than 2.6% in the last session. A break above its next resistance level at 1.2955 should be seen as a solid bullish signal for the pair. The RSI has dropped out from the overbought zone, while the MACD has a deadly cross on the above, suggesting that the bullish momentum is easing. Traders should be cautious for a bearish trend reversal.

Resistance level: 1.2955, 1.3050

Support level: 1.2860, 1.2780

The EUR/USD pair has established an ascending triangle pattern, indicating a bullish bias as it holds above the fair value gap support. While the U.S. dollar remains subdued, the euro has strengthened following upbeat eurozone GDP and employment change data released last Friday. These figures have provided additional tailwinds for the single currency, reinforcing its recent gains and sustaining the pair’s upside momentum in the latest trading sessions.

The pair has formed a higher-low price pattern but is kept below its resistance level at below 1.0900. A break above this level should be a solid bullish signal for the pair. The RSI remains in the overbought zone, but the MACD has a cross above, signalling that the bullish momentum is easing.

Resistance level: 1.0955, 1.1075

Support level: 1.0805, 1.0672

The USD/JPY pair remains in a long-term downtrend, reinforcing a bearish bias amid sustained yen strength. The Japanese yen, a traditional safe-haven asset, has seen increased demand as the U.S. dollar remains volatile due to uncertainties surrounding Trump’s trade policies. Additionally, market participants are pricing in another potential rate hike from the Bank of Japan (BoJ) next week, further bolstering the yen and keeping downward pressure on the pair.

The USD/JPY has reached a new low after the pair has traded bearishly since January. The RSI remains close to the oversold zone, while the MACD continues to edge lower, suggesting that the bearish momentum has been gaining.

Resistance level:149.50, 151.30

Support level: 146.90, 143.80

U.S. stocks saw choppy trading as markets weighed weaker-than-expected labor data against ongoing trade policy uncertainty. Fed Chair Jerome Powell reaffirmed that the central bank is in no rush to cut rates, adding to investor unease ahead of the March 18-19 Fed meeting. Meanwhile, Trump’s decision to pause tariffs on Mexican and Canadian goods provided temporary relief, though Canada delayed its retaliatory duties and Mexico’s response remains uncertain. With trade tensions still looming, market sentiment remains fragile.

Nasdaq is trading flat while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the index might enter oversold territory.

Resistance level: 20550.00, 21045.00

Support level: 19900.00, 19360.00

Natural gas prices have surged to a two-year high, breaching the $5.00 mark for the first time since 2022, as rising demand and record U.S. liquefied natural gas (LNG) exports fuel a bullish outlook. The Trump administration has refrained from imposing restrictions on exports, allowing record-high LNG shipments to optimize global demand despite his recent aggressive trade policies. This has propelled natural gas prices higher, reflecting renewed strength in the market.

Natural gas prices have been trading within their bullish trajectory and have reached new highs since 2022, suggesting a bullish bias for the pair. The RSI is poised to break into the overbought zone while the MACD remains above the zero line, suggesting that natural gas is trading with bullish momentum.

Resistance level: 4.81, 5.16

Support level: 4.42, 4.09

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !