-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

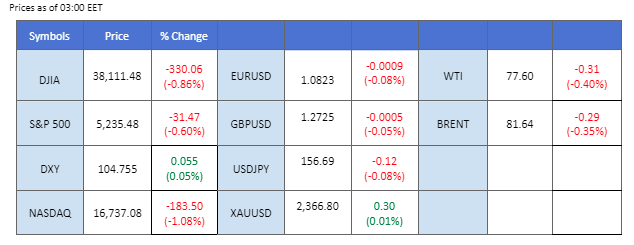

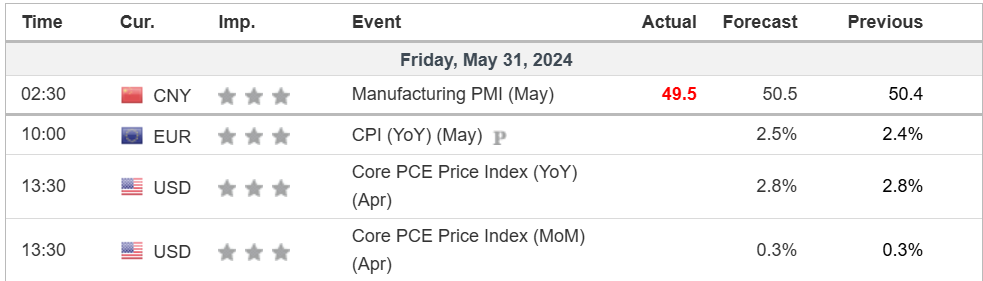

The U.S. dollar failed to sustain its gains following the release of U.S. GDP data that fell short of expectations, coupled with Initial Jobless Claims that exceeded market forecasts. This has prompted a slight shift in market sentiment away from the expectation of a more hawkish Federal Reserve stance. All attention now turns to the crucial PCE reading, the Fed’s preferred inflation gauge, which is expected to have a direct impact on the dollar.

Amid this backdrop, the U.S. equity market continued to slide, with the Dow Jones leading the decline, having dropped more than 2% this week. As the dollar eased yesterday, gold prices seized the opportunity for a technical rebound but remained range-bound. Meanwhile, oil prices continued to be pressured by the high interest rate environment, with ongoing concerns about oil demand outlook.

In Europe, traders are looking ahead to the eurozone CPI data due later today, which will provide further insight into the region’s inflation and help gauge the strength of the euro.

Current rate hike bets on 12th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (99.1%) VS -25 bps (0.9%)

(MT4 System Time)

Source: MQL5

The US Dollar remains volatile, while safe-haven gold rebounded slightly, buoyed by worse-than-expected economic data and political uncertainties following Donald Trump’s historic conviction. Trump, found guilty on all 34 counts of falsifying business records, faces sentencing on July 11. This unprecedented conviction of a former US president has intensified the political instability as he campaigns for the 2024 election against Joe Biden.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 105.15, 105.55

Support level: 104.40, 104.00

Gold prices rebounded slightly ahead of several major events later today. Previously, the conviction of Donald Trump on multiple charges has heightened uncertainties surrounding the 2024 US election, contributing to market instability. On the other hand, market volatility is expected to be high today with the release of the long-awaited US Core Personal Consumption Expenditures (PCE) Price Index. This inflation report is anticipated to trigger significant market movements, prompting investors to shift their portfolios toward safe-haven assets like gold.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the commodity might extend its gains toward resistance level since the RSI rebounded sharply from oversold territory.

Resistance level: 2365.00, 2395.00

Support level: 2330.00, 2305.00

The GBP/USD pair found support at the 1.2695 level, recording a technical rebound from its previous bearish trend. However, the formation of a head-and-shoulders price pattern suggests a potential trend reversal for the pair. All eyes will be on today’s PCE release, which is expected to have a direct impact on the pair and the U.S. dollar.

GBP/USD has eased slightly from its bearish trend, but if the Head-and-Shoulder is formed, this will be a trend-reversal signal for the pair. The RSI is hovering below the 50 level, while the MACD has a bearish divergence and is breaking below the zero line, suggesting a bearish signal for the pair.

Resistance level: 1.2760, 1.2850

Support level: 1.2660, 1.2600

Despite a technical rebound yesterday, the EUR/USD pair has formed a lower low and lower high price pattern, indicating a bearish trajectory. The pair’s movement will be influenced by two crucial economic indicators due today: the eurozone CPI and the U.S. PCE. Euro traders will be closely watching these releases to gauge the pair’s direction.

The EUR/USD was rejected by its strong resistance level at near 1.0880. It is forming a lower low and lower high price pattern, suggesting the pair is trading in a bearish trend. The RSI has been hovering below the 50 levels, while the MACD has broken below the zero line, suggesting a bearish signal for the pair.

Resistance level: 1.0865, 1.0920

Support level: 1.0735, 1.0650

The USD/JPY has dropped back to its price consolidation range at the elevated level, although it has been trading in a bullish trajectory throughout May. The Tokyo Core CPI, released early in the Asian session, came in at 1.9%, an improvement from the previous reading of 1.6%, providing some support for the Yen. Traders will now be eyeing the U.S. PCE reading, set to be unveiled later today, to gauge the future direction of the pair.

The pair has once again traded to its one-month high despite recording a slide in yesterday’s session. It remains trading in the long-term bullish trajectory. The RSI has eased drastically, while the MACD shows signs of breaking below the zero line, suggesting that the bullish momentum is vanishing.

Resistance level: 157.90, 159.50

Support level: 156.60, 155.00

US equity markets tumbled amid the political uncertainty, with investors selling off high-risk assets while awaiting more clarity on the economic and political landscape. The release of the Core Personal Consumption Expenditures (PCE) Price Index later today could further influence market sentiment, as it will provide insights into the inflation trajectory and potential Federal Reserve actions.

Dow Jones is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 28, suggesting the index might enter oversold territory.

Resistance level: 39135.00, 39900.00

Support level: 37810.00, 37160.00

Crude oil prices edged lower due to ongoing uncertainties over Fed interest rate expectations and the upcoming inflation data, which have triggered significant sell-offs in the oil market. The long-term outlook for oil remains unstable, and investors are advised to monitor further events, including the upcoming OPEC+ meeting, for additional trading signals.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 79.95, 82.00

Support level: 77.35, 75.55

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!