-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

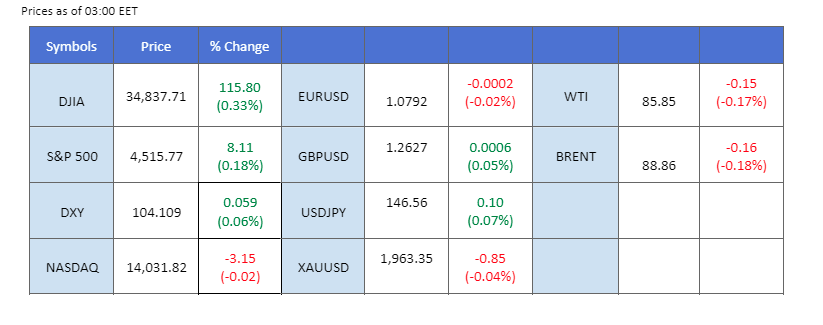

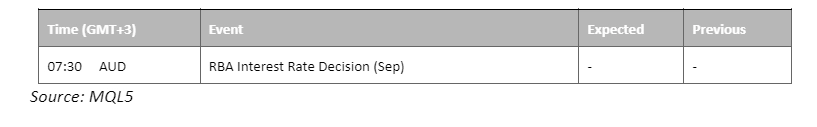

Last night, US markets observed Labor Day celebrations, resulting in a subdued environment across asset classes, marked by sideways trading. Conversely, China’s equity market experienced a morning session decline. The catalyst was a Caixin Services PMI reading that not only fell short of market consensus but also trailed the previous figure, underscoring persistent challenges in China’s ongoing economic recovery. Elsewhere, all eyes are on the Reserve Bank of Australia (RBA), set to announce its interest rate decision today. It’s widely anticipated that the central bank will maintain its current interest rate level, which could further pressure the already fragile Australian dollar. Meanwhile, oil prices have remained stable at their highest levels since last November, with market participants eagerly awaiting the next moves from OPEC+ regarding supply dynamics.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 20 septembre Décision de la Fed sur les taux d'intérêt:

Source : Outil Fedwatch du CME

0 bps (93.0%) VS 25 bps (7.0%)

Dollar-denominated assets experienced subdued trading on the back of the recent US holiday. The US dollar, navigating thin volumes, retreated slightly, influenced by a global risk-on sentiment. This shift followed China’s unveiling of a stimulus plan aimed at reinvigorating economic growth, while the outlook for the US economy remained shrouded in uncertainty due to mixed economic data.

L'indice du dollar a étendu ses gains suite à la rupture précédente au-dessus du niveau de résistance précédent. Cependant, le MACD a montré une diminution de la dynamique haussière, tandis que le RSI est à 62, ce qui suggère que l'indice pourrait être négocié à la baisse dans le cadre d'une correction technique puisque le RSI s'est retiré de la zone de surachat.

Niveau de résistance : 104,50, 105,15

Niveau de support : 103.60, 102.80

Dans le domaine des métaux précieux, le marché de l'or a continué à se consolider à l'intérieur d'une fourchette définie par des niveaux de soutien et de résistance cruciaux. Le marché a été confronté à des données économiques mitigées en provenance des États-Unis, ce qui a renforcé l'incertitude.

Le prix de l'or se négocie à la baisse suite au retracement précédent du niveau de résistance. Le MACD a illustré une dynamique baissière croissante, tandis que le RSI est à 50, ce qui suggère que la marchandise pourrait étendre ses pertes vers le niveau de support.

Niveau de résistance : 1950.00, 1970.00

Niveau de support : 1920.00, 1900.00

The euro exhibited limited price movement against the USD during the U.S. Labor Day celebrations. Despite a speech by ECB Chair Christine Lagarde in London touching on inflation concerns, the pair’s volatility remained subdued. Investors are now focusing on the upcoming release of Eurozone GDP data on Thursday, which could provide insights into the Euro’s future strength.

L'EUR/USD est en difficulté et sur le point de tomber en dessous de son niveau de support crucial à 1,0780. Le RSI est proche de la zone de survente tandis que le MACD s'écoule à plat sous la ligne de zéro, ce qui suggère que la dynamique de la paire est minimale.

Niveau de résistance : 1,0850, 1,0920

Niveau de support : 1.0760, 1.0700

The Australian dollar broke out of its recent price consolidation range, driven by disappointing economic news out of China. China’s Caixin Services PMI came in at 51.8, lower than the previous reading of 54.1, indicating ongoing challenges in the country’s economic recovery. This data has added downward pressure on the already fragile Aussie dollar. Additionally, with the RBA expected to announce its interest rate decision today, and the market widely anticipating the central bank to maintain the current interest rate, it’s expected that the Aussie dollar will face further resistance in rebounding from its current levels.

La paire n'a pas réussi à se maintenir au-dessus de son niveau de support à 0,6440, ce qui suggère un signal baissier pour la paire. Les indicateurs font écho à cette suggestion, le RSI se déplaçant vers le bas tandis que le MACD se brise sous la ligne de zéro.

Niveau de résistance : 0,6500, 0,6580

Niveau de support : 0.6380, 0.6330

The Japanese yen extended its underperformance, driven by the Bank of Japan’s (BoJ) adoption of a more dovish stance. This shift in monetary policy reaffirmed the BoJ’s status as the sole central bank globally maintaining negative interest rates. Moreover, prospects of currency intervention by the BoJ remained bleak, exacerbating the downward pressure on the Japanese yen.

La paire USD/JPY se négocie à la hausse suite à la cassure précédente au-dessus du niveau de résistance précédent. Le MACD a illustré une dynamique haussière croissante, tandis que le RSI est à 60, suggérant que la paire pourrait étendre ses gains vers le niveau de résistance.

Niveau de résistance : 147,20, 148,25

Niveau de support:146.25, 144.70

Chinese equities experienced an upswing, with the Hang Seng Index surging by over 2%. This rally was fueled by the Chinese government’s stimulus plan and news that Country Garden Holdings had garnered bondholder approval to extend certain debt deadlines. Notably, the stock of Country Garden Holdings soared by more than 15%, emerging as a top performer on the Hang Seng Index, as optimism mounted that the beleaguered property developer could avert a potential default.

Le HK50 se négocie à la hausse suite à la rupture précédente au-dessus du niveau de résistance. Cependant, le MACD a montré une diminution de la dynamique haussière, tandis que le RSI est à 60, ce qui suggère que l'indice pourrait être négocié à la baisse dans le cadre d'une correction technique étant donné que le RSI a fortement reculé depuis le territoire de surachat.

Niveau de résistance : 18950.00, 19270.00

Niveau de support : 18630.00, 18235.00

Oil prices remained buoyant, hovering near three-week highs, buoyed by optimism surrounding potential output cuts by leading crude producers. Russia’s mention of forthcoming supply reductions added to speculation that Saudi Arabia would extend its one million barrel per day production cut into October, further bolstering global supply constraints.

Les prix du pétrole se négocient à la hausse après avoir dépassé le niveau de résistance précédent. Cependant, le MACD a montré une diminution de la dynamique haussière, tandis que le RSI est à 69, ce qui suggère que le produit de base pourrait entrer en territoire suracheté.

Niveau de résistance : 87,25, 93,10

Niveau de support : 83.80, 80.45

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !