-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

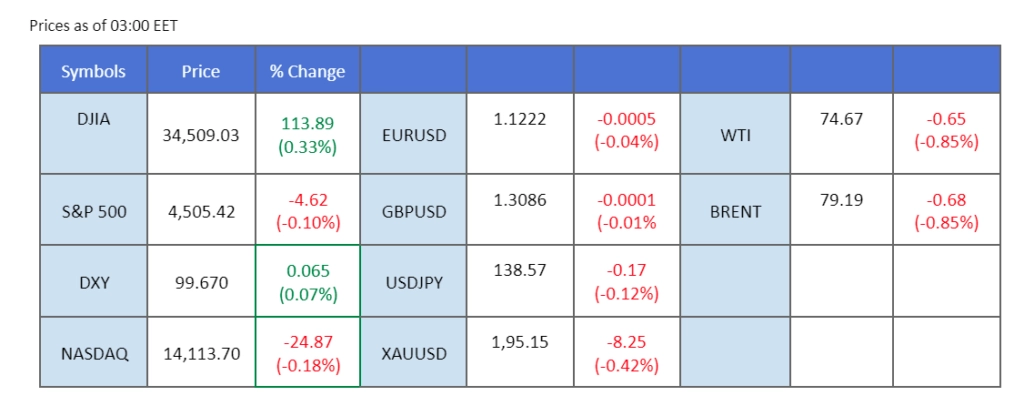

Investors are wagering that the upcoming rate hike in July will mark the end of the tightening cycle, yet Federal Reserve officials are keeping their options open for a potential increase later in the year. Surprisingly, the dollar has failed to garner support despite the Fed’s hawkish stance, as the dollar index continues to hover below the psychological threshold of $100. On another front, the latest release of China’s second-quarter GDP has fallen short of market expectations, clocking in at a lacklustre 6.3%. This disappointing performance from the Chinese economy has exerted upward pressure on oil prices. Elsewhere, gold prices retreated in early Asian trading as investors seized the opportunity to capitalize on their gains. However, the long-term outlook for gold remains positive due to the downturn in economic data and dovish statements from the United States.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 26 juillet Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (8%) VS 25 bps (92%)

The Dollar Index, which tracks the performance of the US dollar against a basket of major currencies, staged a recovery after hitting a 15-month low. Investor sentiment shifted as profit-taking took place, prompting a temporary bounce in the greenback. However, the outlook for the currency remained gloomy, given disappointing inflation reports and dovish statements from the Federal Reserve.

The dollar index is lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 28, suggesting the index might enter oversold territory.

Niveau de résistance : 101,45, 104,25

Niveau de support : 98,70, 94,75

In early Asian trading, gold prices experienced a slight retreat as investors decided to capitalise on their gains. Despite this temporary dip, the long-term trajectory for this precious commodity remains bullish. The downturn in economic data and the dovish statements made by the United States have compelled investors to restructure their portfolios by embracing the safe-haven appeal of gold. Moving forward, investors will closely monitor the monetary decisions of the Federal Reserve, as they seek valuable trading signals to guide their investment strategies.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 54, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Niveau de résistance : 1970.00, 1985.00

Support level: 1950.00, 1930.00

While the dollar remains weakened, the euro has made gains against the USD, reaching its highest level since March of last year. However, the upward momentum for the euro has slightly eased, hovering around the 1.1220 level, as traders await additional catalysts to drive the pair to trade higher. The upcoming release of Euro CPI on Wednesday is anticipated to have an impact on the pair’s performance. Additionally, investors will closely monitor the release of U.S. retail sales data on Tuesday to gauge potential movements in the pair’s price.

EUR/USD traded strongly and has been hovering at its highest level since last March. The RSI showed that the pair is training in an overbought zone while the MACD has crossed above the zero line suggesting a slight trend reversal for the pair.

Niveau de résistance : 1,1338, 1,1410

Niveau de support : 1.1157, 1.1088

The sterling has gained an advantageous position against the dollar, particularly following the release of last week’s U.S. Consumer Price Index (CPI) report, which indicated that inflation in the United States appears to be well-contained. In contrast, the inflation rate in the United Kingdom remains relatively high compared to its counterparts. As a result, the BoE is anticipated to adopt an assertive stance in its monetary tightening policy to rein in the persistent inflationary pressures. The upcoming release of UK CPI data on Wednesday will undoubtedly capture significant attention, as market participants eagerly await its potential impact on the Cable, the GBP/USD currency pair.

Cable’s bullish momentum has eased after trading to its highest level since last April. The RSI has dropped out from the overbought zone while the MACD has crossed above the zero line suggesting a trend reversal for the Cable.

Resistance level: 1.3199, 1.3275

Support level: 1.3000, 1.2910

The Dow continues to trade flat ahead of several crucial earning reports. The upcoming week marks the beginning of the second-quarter earnings season, with a flurry of prominent companies expected to release their financial results. Among them, Bank of America and Goldman Sachs are set to report their earnings on Tuesday and Wednesday, respectively. Meanwhile, several market participants are eyeing Tesla, which has been a dominant force in the US stock market recently, as the electric vehicle manufacturer unveils its financial performance on Wednesday.

The Dow is trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the pair might extend its gains after successfully breakout above the resistance level.

Resistance level: 34550.00, 34895.00

Support level: 33715.00, 32695.00

Chinese-proxy currencies, including the Australian Dollar, slumped significantly as China reported a second-quarter GDP miss and a modest pickup in the US treasury yields sparked bullish momentum on the US Dollar. China’s GDP grew by only 6.3% from a year ago, falling short of the market’s 7.30% expectations. The initial economic rebound that China had witnessed has now lost momentum. The formidable real estate sector continues to struggle in its recovery efforts, while exports have taken a significant hit due to the declining global demand.

AUD/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the pair might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 0.6885, 0.6990

Support level: 0.6815, 0.6750

After three consecutive weekly gains, oil prices experienced a decline of over a dollar per barrel on Friday. The retreat was attributed to a strengthening dollar and profit-taking by oil traders who sought to capitalise on the recent strong rally in prices. Meanwhile, the oil market extended its losses after China released its downbeat economic data. China’s GDP grew by only 6.3% from a year ago, falling short of the market’s 7.30% expectations.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Niveau de résistance : 77,30, 79,75

Niveau de support : 73.70, 70.30

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !