-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

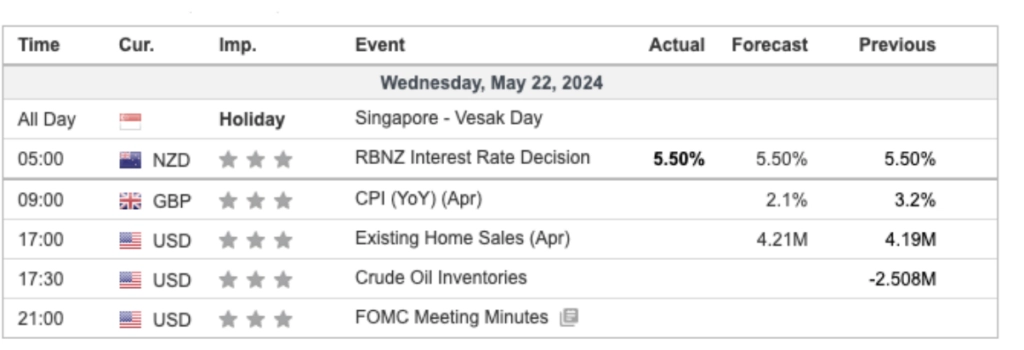

The US Dollar remained subdued as investors awaited the FOMC meeting minutes, with Federal Reserve officials emphasising the need for more evidence of easing inflation before considering rate cuts. This cautious stance has kept the dollar in check, influencing other markets as well.

Gold prices stayed flat but slightly retreated due to the appreciating dollar and cautious comments from Fed members about the risks of cutting rates prematurely. Investors are closely monitoring Fed monetary policy decisions for further trading signals.

The British Pound edged higher in anticipation of the UK Consumer Price Index (CPI) data. Expectations of a significant drop in inflation could prompt early rate cuts by the Bank of England, with potential cuts speculated between June and August. Investors are advised to monitoring UK Consumer Price Index (CPI)

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 12 juin Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (91.1%) VS -25 bps (8.9%)

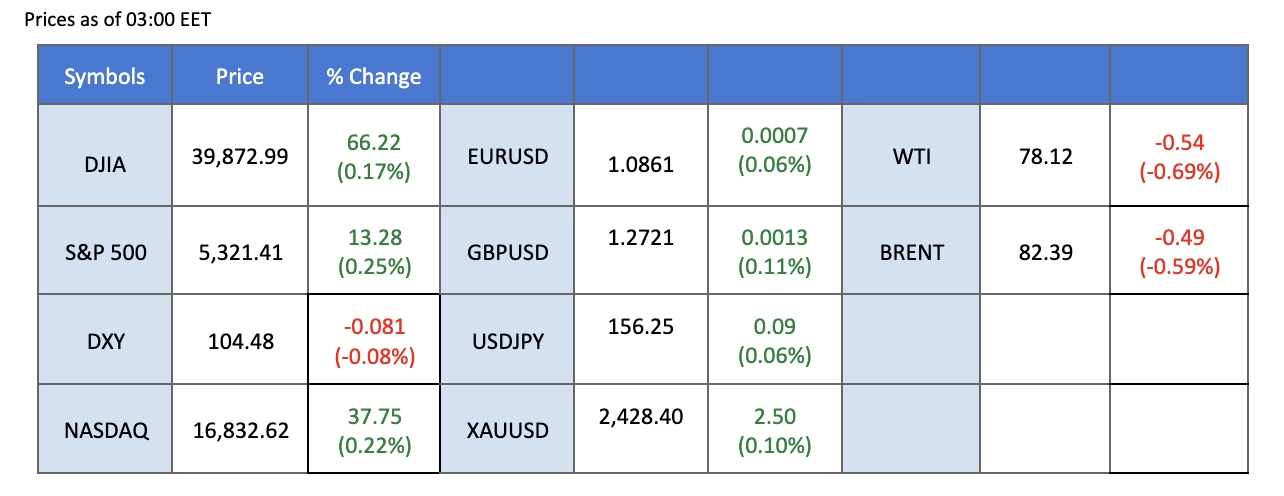

Aperçu du marché

(Heure du système MT4)

Source : MQL5

Mouvements du marché

The US Dollar remained subdued due to a lack of market catalysts, as investors await the release of the Federal Open Market Committee (FOMC) meeting minutes later this week. Several Fed officials have cautioned that more evidence of easing inflation is needed before considering interest rate cuts, indicating that rate decisions remain data-dependent.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the index might experience technical correction since the RSI stays below the midline.

Resistance level: 104.65, 105.70

Support level: 103.90, 103.15

Gold prices remained flat but retreated slightly due to the appreciation of the US Dollar following cautious comments from Fed members on the risks of cutting rates prematurely. The overall trend is attributed to technical correction ahead of major events like the FOMC meeting minutes. Investors are advised to monitor Fed monetary policy decisions for further trading signals.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the commodity might extend its losses after breakout since the RSI retraced sharply from overbought territory.

Resistance level: 2450.00, 2480.00

Support level: 2420.00, 2395.00

The British Pound edged slightly higher in anticipation of the UK Consumer Price Index (CPI) data for April. Economists expect the UK Office for National Statistics (ONS) to report a sharp decline in headline inflation to 2.1% from the previous 3.2%. A significant drop in inflation could increase the likelihood of the Bank of England (BoE) considering early rate cuts, with speculations pointing to potential cuts between June and August. Investors should continue monitoring these developments for further trading signals.

GBP/USD is trading higher following the prior breakout above the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 68, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.2795, 1.2865

Support level: 1.2695, 1.2610

The Euro remained flat but hovered around a strong resistance level, mainly due to technical correction trades. This week, investors will focus on remarks from Fed officials and the absence of key US data releases. Meanwhile, European Central Bank (ECB) President Christine Lagarde’s speech and the minutes from the recent FOMC meeting will be closely watched. Investors should monitor these developments for further trading signals.

EUR/USD is trading flat while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 54, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1.0865, 1.0925

Support level: 1.0805, 1.0730

The Japanese Yen continued to weaken due to a lack of updates from the Bank of Japan (BoJ) regarding potential currency intervention. The widening yield differential between Japan and the US, especially after Fed members vowed to maintain higher interest rates for an extended period, has prompted further sell-off of the Yen. Investors should keep an eye on the FOMC meeting minutes for further trading signals.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the pair might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 156.55, 158.20

Support level: 153.65, 152.10

US equity markets extended gains slightly, driven by persistent performance in technology stocks and anticipation of key earnings from Nvidia. Confidence in the US equity market remains strong, fueled by the rapid growth of the artificial intelligence industry, which is expected to significantly boost earnings, particularly in the semiconductor sector. Nvidia, known for its advanced AI chips, is expected to benefit substantially from demand in major tech companies.

Nasdaq is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 77, suggesting the index might enter overbought territory.

Niveau de résistance : 19125,00, 19690,00

Niveau de support : 18430.00, 17850.00

Oil prices retraced slightly due to hawkish statements from Fed members, who have vowed to keep interest rates higher for longer, weighing on fuel demand. Investors remain cautious ahead of major events, including the FOMC meeting minutes and weekly US oil inventory data from the Energy Information Administration (EIA), which are expected to provide further trading signals.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 79.85, 81.35

Support level: 77.75, 76.90

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !