-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

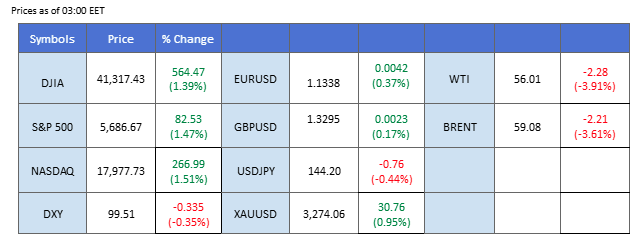

Market Summary

Markets were mixed Monday as geopolitical tensions weighed on sentiment. The U.S. dollar index (DXY) dipped below 100.00 after initial optimism over U.S.-China trade talks faded. Reports of deepening U.S.-Taiwan ties raised fears of Chinese retaliation, clouding the outlook and muting expectations for near-term Fed rate cuts amid persistent inflation.

Gold surged over 2% to $3,300/oz on renewed safe-haven demand, with traders seeking protection against rising geopolitical and policy risks.

U.S. equities were uneven—tech stocks held firm on strong earnings, while cyclicals and media underperformed after the White House floated steep tariffs on foreign films. In Asia, Taiwan and the Philippines declined on regional tensions, while Australia rose post-election. European markets were flat in quiet holiday trade.

Oil prices bounced to $57.50/bbl after OPEC+ unexpectedly raised output by 411,000 bpd. The move, seen as a concession to consumer nations, raised questions about cohesion within the group as Saudi Arabia pivoted to defend market share.

With inflation and geopolitics back in focus, investor attention turns to upcoming Fed commentary for policy clarity.

Current rate hike bets on 7th May Fed interest rate decision:

0 bps (92.3%) VS -25 bps (7.7%)

Source: CME Fedwatch Tool

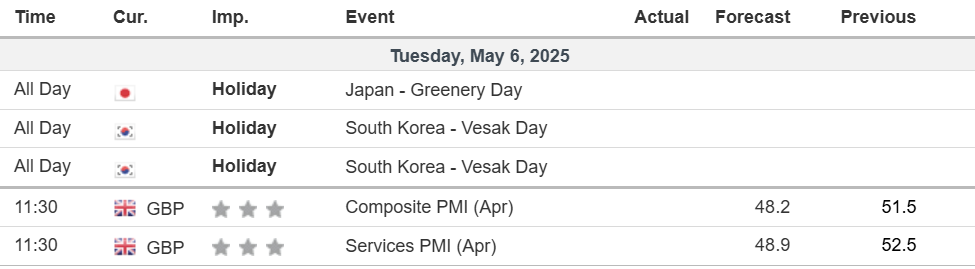

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remained subdued in the latest session, hovering below the key 100.00 mark, as investors weighed the implications of President Trump’s proposed tariffs on foreign movies—an unexpected move that stirred fresh market uncertainty. While a hawkish outlook for the Federal Reserve typically underpins the greenback, the lack of clarity from the administration’s trade agenda has eroded investor confidence, limiting gains for the dollar.

The dollar index hovered flat in the last session, giving a neutral signal for the index. The RSI stayed close to the 50 level while the MACD eased toward the zero line from above, suggesting that the bullish momentum is dwindling.

Resistance level: 100.26, 101.95

Support level: 98.35, 96.80

The recent appreciation of the Taiwan dollar—partly driven by speculation surrounding a potential US-Taiwan trade agreement that may include currency adjustments—has added complexity to global trade dynamics. This development comes against the backdrop of already strained US-China relations, increasing geopolitical risk and driving renewed demand for safe-haven assets such as gold.

Gold is currently testing a critical resistance level at 3355.00. MACD indicates strengthening bullish momentum, while RSI at 63 supports the potential for further upside. A confirmed breakout above 3355.00 could pave the way for a move toward the next resistance level at 3420.00.

Resistance levels: 3355.00, 3420.00

Support levels: 3270.00, 3200.00

GBP/USD remains under pressure, falling below 1.3300 as weak U.K. economic indicators contrast with resilient U.S. data. The seventh straight contraction in U.K. manufacturing PMI and still-high core inflation (4.2% YoY) highlight stagflation risks. Markets fully price in a 25bps cut from the BoE on May 9, with up to 100bps seen by year-end. Meanwhile, the Fed’s data-driven hold supports a stronger dollar and limits GBP upside.

GBP/USD continued to consolidate below recent highs, holding beneath key resistance near 1.3340, reflecting a neutral-to-bearish undertone. RSI is hovering around 44, just below the neutral 50 level, indicating subdued momentum and lack of directional conviction. Meanwhile, MACD remains slightly below the zero line with the MACD and signal lines converging, pointing to market indecision, though the slight bearish tilt suggests that downside risks remain in play.

Resistance level: 1.3340, 1.3420

Support level: 1.3270, 1.3185

EUR/USD faded from recent highs as strong U.S. data and resilient yields revived dollar demand. Despite Eurozone core CPI rising to 2.7%, markets remain focused on weak industrial activity and ECB easing expectations for June. The Fed, in contrast, looks increasingly likely to hold rates steady beyond mid-year. U.S. tariff risks persist but are currently overshadowed by relative economic strength, keeping EUR/USD under pressure despite ECB-Fed divergence.

EUR/USD is attempting to stabilize after rebounding off support around the 1.1286 level, though upward momentum remains muted as the pair struggles to reclaim the next resistance zone. The RSI is fluctuating around the 45 mark, staying below the neutral 50 level, which reflects a lack of strong bullish conviction but hints at a potential easing in selling pressure. Meanwhile, the MACD is flat and hovering just beneath the zero line, with the MACD and signal lines running nearly parallel—highlighting indecision in the market and a possible period of consolidation ahead.

Resistance level: 1.1430, 1.1540

Support level: 1.1285, 1.1190

Market sentiment wavered following the Trump administration’s latest tariff proposal—this time targeting foreign films with a potential 100% levy. The unexpected move has injected fresh uncertainty into the market, undermining support for the dollar and sparking a shift toward safe-haven currencies, particularly the Swiss franc. The policy surprise raises concerns over escalating protectionism, which could weigh further on the greenback in the near term.

The USDCHF pair formed a double-top price pattern and later moved lower, suggesting a bearish bias for the pair. The RSI and the MACD both flow in a lower-high pattern, suggesting that the bullish momentum is vanishing, in line with the bearish view for the pair.

Resistance level: 0.8314, 0.8413

Support level: 0.8200, 0.8110

USD/JPY climbed as policy divergence deepened, driven by dovish signals from the BoJ and solid U.S. economic data. Governor Ueda’s cautious tone and downgraded growth forecasts suggest the BoJ will remain behind the curve, keeping rates near zero. Meanwhile, the U.S. labor market beat expectations in April, with NFP and ISM Services PMI both surprising to the upside, reducing urgency for Fed cuts and lifting Treasury yields. This backdrop, combined with improving risk sentiment, continues to suppress safe-haven demand for the yen.

USD/JPY is easing lower after failing to sustain a recent recovery, with sellers gradually regaining control as price pulls back from overhead resistance. The RSI has dipped below the 50 threshold, indicating fading bullish momentum and suggesting the potential for further downside if bearish pressure persists. Meanwhile, the MACD is turning negative, with the histogram and signal line both trending lower—reflecting weakening upside traction and reinforcing a cautious-to-bearish near-term bias.

Resistance level: 143.95, 147.15

Support level: 140.45, 137.50

Crude oil prices remain weak, hovering near four-year lows after OPEC+ announced a production increase of 411,000 barrels per day. The decision has raised concerns about a potential oversupply, especially as demand remains uncertain due to global recession risks.

Oil prices are trending lower following a confirmed breakdown below prior support. MACD signals growing bearish momentum, and RSI at 33 suggests increased downside risk. A breach below 52.05 may open the path toward 47.20. Conversely, failure to maintain this downward move could result in a short-term rebound toward resistance at 57.80.

Resistance levels: 57.80, 65.20

Support levels: 52.05, 47.20

With the crypto market lacking fresh catalysts, digital assets have been largely mirroring broader financial sentiment. Bitcoin (BTC) continues to trade sideways as investor risk appetite fades, following President Trump’s surprise proposal to impose steep tariffs on the entertainment industry—a move that rattled Wall Street and spilled over into crypto markets. Despite the stagnant price action, BTC dominance continues to climb, signaling sustained investor preference for Bitcoin over alternative tokens amid elevated uncertainty.

BTC has been extremely sideways and flowing at the lowest levels in May. Referring to the momentum indicators, both the RSI and MACD have been moving downward, with the RSI approaching the oversold zone while the MACD crossing below the zero line, suggesting that the bearish momentum is gaining.

Resistance level: 102,000.00, 107,840.00

Support level: 91,750.00, 85,500.00

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!