-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

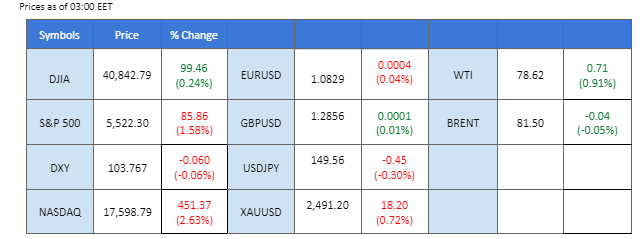

The highly anticipated Fed’s interest rate decision was disclosed yesterday, hammering the dollar’s strength lower as Fed Chief Jerome Powell explicitly signalled that a September rate cut is possible. The U.S. central bank is balancing both inflation and recession risks, with interest rates adjusted to curb inflation while maintaining a solid labour market.

On Wall Street, the dovish Fed stance catalysed a rally, with the Nasdaq leading the charge, rising by more than 400 points yesterday as lower borrowing costs favour the tech industry. In contrast to the U.S. dollar, the Japanese yen continued to strengthen following a 15 bps rate hike by the BoJ yesterday. The USD/JPY pair broke below the 150 psychological mark in the Sydney session, trading at its lowest level since March.

In the commodity markets, safe-haven gold surged sharply after reports of the Hamas chief being killed in Iran, intensifying regional tensions. Oil prices also recorded their biggest single-day gain in two months due to the uncertainty in the Middle East, which could disrupt oil supply.

Traders are also keeping an eye on today’s BoE interest rate decision, expected to include a 25 bps reduction to mitigate recession risks in the UK economy.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 18 septembre Décision de la Fed sur les taux d'intérêt:

Source : Outil Fedwatch du CME

0 bps (88.5%) VS -25 bps (11.5%)

(Heure du système MT4)

Source : MQL5

The Dollar Index, which trades against a basket of six major currencies, retreated sharply after the Federal Reserve decided to maintain interest rates but signalled potential rate cuts as soon as September. The Federal Open Market Committee left the federal funds rate in the range of 5.25% to 5.50%. Market participants focused on the monetary policy statements, which leaned dovish, indicating that policymakers are closer to reducing borrowing costs as progress towards the 2% inflation objective continues. However, future decisions will remain data dependent. The next focal point for market participants will be the US economic data on Friday, including Nonfarm Payrolls and the Unemployment rate.

L'indice du dollar se négocie à la baisse tout en testant actuellement le niveau de support. Le MACD a illustré une dynamique baissière croissante, tandis que le RSI est à 35, suggérant que l'indice pourrait étendre ses pertes après la rupture puisque le RSI reste en dessous de la ligne médiane.

Niveau de résistance : 104,75, 105,15

Support level: 104.00, 103.65

Gold prices rebounded and extended their gains, driven by two major factors. First, the Federal Reserve’s dovish tone and hints at potential rate cuts bolstered demand for the non-yielding asset. Second, the escalating tensions in the Middle East added to the safe-haven appeal of gold, as investors sought protection against rising geopolitical risks.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 75, suggesting the commodity might enter overbought territory.

Resistance level: 2420.00, 2450.00

Support level: 2390.00, 2355.00

The GBP/USD pair remains stable ahead of the BoE interest rate decision due later today. The British central bank is expected to implement its first post-pandemic rate cut of 25 bps. If the decision aligns with market expectations, it could exert downside pressure on the Sterling. However, the dovish statement from the Fed last night, which left the interest rate unchanged, has hindered the dollar’s strength due to heightened speculation of a September rate cut. This has buoyed the GBP/USD pair, allowing it to maintain its current level.

GBP/USD continued trading sideways after the pair plunged nearly 1.5% for the past two weeks. The RSI is rebounding, while the MACD edged higher, suggesting that the bearish momentum is easing.

Resistance level: 1.2940, 1.2995

Support level: 1.2785, 1.2660

The EUR/USD found support in the last session near the 1.0805 level. The euro was bolstered by the eurozone CPI reading, which exceeded market expectations at 2.6%, suggesting that the next rate cut from the ECB may not occur soon. Meanwhile, the Fed is expected to cut its interest rate in September, as Jerome Powell explicitly signalled following the Fed’s interest rate decision announcement yesterday.

The EUR/USD pair is seemingly easing from the bearish momentum and the pair has started to consolidate following a 2 weeks long downtrend. The RSI has rebounded while the MACD is edging higher toward the zero line from below, suggesting the bearish momentum is easing.

Resistance level: 1.0853, 1.0895

Support level: 1.0770, 1.0732

The Japanese yen continued to strengthen after the BoJ surprised the market by raising the rate by 15 bps. In contrast, the Fed announced an interest rate decision that aligned with market expectations, heightening speculation of a September rate cut, which could weaken the dollar further. Consequently, the USD/JPY pair broke below its psychological support level at the 150 mark, suggesting a bearish bias for the pair.

The downside risk has increased and has dropped nearly 8% for the past three weeks. The RSI has dropped into the oversold zone, while the MACD has edged lower and is diverging, suggesting that the bearish momentum is gaining.

Resistance level: 150.50, 152.50

Support level: 148.65, 146.75

The Nasdaq surged following the Fed’s indication of potential rate cuts in the upcoming September meeting. The Fed acknowledged recent progress on inflation and cooling in the labor market, fueling hopes for rate cuts. US Treasury yields dipped slightly, while high-growth tech companies, including Nvidia and Qualcomm, rallied, supporting the broader US equity indexes

Nasdaq is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Niveau de résistance : 20015.00, 20705.00

Support level: 18975.00, 18215.00

Oil prices rebounded sharply due to rising Middle East tensions and a larger-than-expected decline in US crude inventories. The assassination of Ismael Haniyeh, the leader of Hamas, in Tehran, following the killing of a Hezbollah commander, heightened concerns about major disruptions to global supplies and diminished chances for a ceasefire in the ongoing conflict. Additionally, the Energy Information Administration reported a significant decline in US inventories by nearly 3.4 million barrels in the week ending July 26, marking the fifth consecutive week of draws due to robust fuel demand during the travel-heavy summer season.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Niveau de résistance : 78,55, 80,90

Support level: 76.10, 74.35

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !