-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

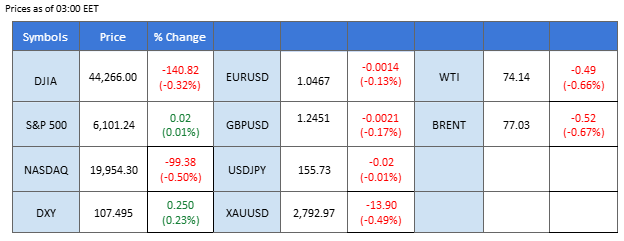

Synthèse du marché

This week, the financial market remains focused on the U.S. dollar, which has been heavily influenced by Donald Trump’s statements and proposed tariff policies. The president-elect recently threatened Columbia with high tariffs over immigration issues, adding support to the dollar’s strength. Meanwhile, attention is on Wednesday’s FOMC interest rate decision, with the market anticipating a hawkish stance from the Federal Reserve that could further buoy the dollar.

Despite a rate hike last Friday, the Japanese Yen has struggled in recent sessions. Traders will look to tomorrow’s CPI reading for clues on the Yen’s strength. In the commodity market, oil prices continue to decline amid concerns over a potential increase in supply by 2025, coupled with disappointing Chinese PMI data that has weighed on demand.

In the gold market, the precious metal faced resistance near its all-time high, retreating by 1%. However, if gold can hold above the $2,754 support level, it may continue to trade within a bullish trajectory, given its safe-haven appeal in the face of global uncertainties.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 29 janvier Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (97.9%) VS -25 bps (2.1%)

Aperçu du marché

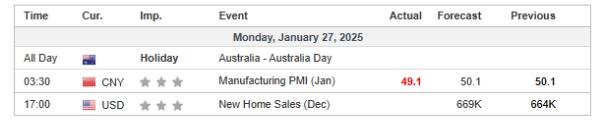

Calendrier économique

(Heure du système MT4)

Source : MQL5

Mouvements du marché

INDICE_DOLLAR, H4

The U.S. dollar fell on Friday as dovish expectations grew following President Donald Trump’s renewed calls for immediate interest rate cuts. Speaking at the World Economic Forum in Davos, Trump urged global central banks to lower rates, hinting at potential political pressure on the Federal Reserve ahead of its upcoming policy meeting. Investors reacted by reducing dollar exposure, though uncertainty remains over whether the Fed will respond to Trump’s rhetoric.

The Dollar Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the index might experience technical correction since the RSI rebounded from oversold territory.

Niveau de résistance : 107,95, 108,90

Support level: 107.15, 106.45

Gold prices edged lower as traders took profits, leading to a technical correction. However, the long-term outlook for gold remains bullish, as Trump’s call for lower interest rates could increase demand for safe-haven assets. If the Federal Reserve adopts a more accommodative stance in response to economic concerns, gold could see renewed upside momentum.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 42, suggesting the commodity might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 2780.00, 2800.00

Support level: 2750.00, 2720.00

The GBP/USD pair has climbed to a three-week high, continuing to trade within its established uptrend channel, signaling a bullish outlook. This upward movement has been supported by last Friday’s UK PMI readings, which strengthened the Pound Sterling. However, traders should remain cautious ahead of Wednesday’s FOMC interest rate decision, as it could significantly influence the pair’s price trajectory.

GBP/USD remains trading within its uptrend channel, suggesting a bullish bias for the pair. The RSI remains close to the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong.

Niveau de résistance : 1,2505, 1,2620

Niveau de support : 1.2407, 1.2310

The EUR/USD pair maintains its bullish momentum, breaking above the critical resistance level at 1.0460, signaling a continued upward bias. The Euro gained support from last Friday’s upbeat PMI readings, coupled with a subdued U.S. dollar in recent sessions. As optimism builds, traders now await Wednesday’s ECB monetary policy statement for insights into future policy directions and their potential impact on the Euro.

The EUR/USD continues to create a higher-high price pattern, suggesting a bullish bias for the pair. The RSI remains close to the overbought zone, while the MACD edges higher, suggesting that the bullish momentum remains solid.

Niveau de résistance : 1,0528, 1,0608

Niveau de support : 1.0345, 1.0232

The Japanese yen gained after the Bank of Japan (BOJ) raised its benchmark interest rate by 25 basis points—the first-rate hike since the 2008 financial crisis. The move signals growing confidence in Japan’s economic recovery, supported by rising wages and sustained inflation. With this shift, the BOJ moves further away from its ultra-loose monetary policy, reinforcing expectations of a stronger yen in the near term.

USD/JPY is trading lower following prior retracement from the resistance level. MACD illustrated increasing bearish momentum, while RSI is at 47, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 156.60, 158.05

Niveau de support : 155.00, 154.05

The tech-heavy Nasdaq index paused its bullish momentum after approaching near all-time high levels, as the recent AI-driven rally faced a setback. The interruption stemmed from China’s DeepSeek, an emerging AI startup positioned as a more efficient and cost-effective competitor to OpenAI, Google, and Meta, stirring market uncertainty. Meanwhile, major tech giants Microsoft, Apple, and Meta Platforms are set to release their earnings reports this week, which could play a crucial role in determining the direction of Nasdaq’s next price.

Nasdaq remains trading within its bullish trajectory after breaking above from its downtrend channel despite the recent bullish momentum easing. The RSI remains kept at above the 50 level, while the MACD continues to diverge after breaking above the zero line, suggesting that the index remains trading with bullish momentum.

Resistance level: 22590.00, 23170.00

Support level: 21250.00, 20730.00

Bitcoin has broken below its ascending triangle pattern, signaling a bearish bias for BTC. The broader risky asset market, including Wall Street, experienced a wave of sell-offs last Friday, reducing overall risk-on sentiment. Market participants are closely monitoring potential policy announcements from Trump’s administration regarding the digital asset market, alongside developments surrounding the launch of XRP and SOL ETFs, which could provide a fresh catalyst for BTC prices.

BTC has broken below from the ascending triangle price pattern, suggesting a bearish bias for BTC. The RSI has dropped below the 50 level while the MACD has slid to near the zero line from above, suggesting that the bullish momentum is vanishing.

Resistance level: 105400.00, 108130.00

Support level: 98730.00, 94650.00

Crude oil prices continued to slide as traders assessed Trump’s push for lower oil prices. Trump publicly called on OPEC to reduce energy costs, adding uncertainty ahead of the cartel’s upcoming meetings. While Saudi Arabia and OPEC officials have yet to respond, the pressure may influence future production decisions, particularly amid ongoing geopolitical tensions and economic risks.

Crude oil is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the commodity might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 75.05, 77.05

Support level: 72.65, 70.40

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !