-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

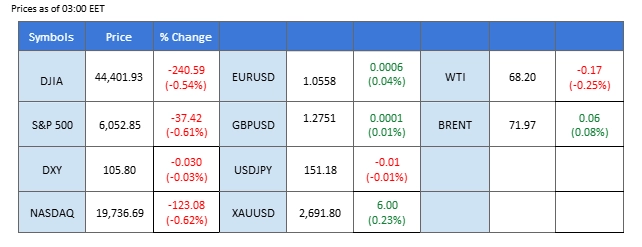

Synthèse du marché

Les actions chinoises ont grimpé en flèche, les principaux dirigeants ayant annoncé des mesures de relance plus agressives pour revitaliser l'économie. L'indice Hang Seng et l'indice China A50 ont tous deux progressé de plus de 3% au cours de la séance précédente, et la dynamique s'est poursuivie dans les échanges d'aujourd'hui. Les prix du pétrole ont rebondi par rapport à leurs niveaux les plus bas, soutenus par les plans de relance économique de la Chine et les tensions géopolitiques au Moyen-Orient, avec l'apparition d'informations selon lesquelles des groupes rebelles syriens auraient renversé le régime d'Assad. L'or a atteint son plus haut niveau en deux semaines, reflétant la demande accrue d'actifs sûrs dans un contexte d'incertitudes géopolitiques croissantes.

Le yen japonais a poursuivi sa chute malgré des données économiques meilleures que prévu publiées hier. Le scepticisme du marché quant à la capacité de la Banque du Japon à relever ses taux d'intérêt, associé à une incertitude géopolitique accrue, a pesé sur la monnaie.

The U.S. dollar gained ground following robust labor market data last Friday, which showed lower unemployment and higher wage growth. Traders are now awaiting Wednesday’s U.S. inflation data, which could offer further clarity on the Federal Reserve’s monetary policy trajectory.

Par ailleurs, le dollar canadien subit des pressions à la baisse avant la décision de la Banque du Canada concernant les taux d'intérêt, qui sera publiée demain. Les marchés anticipent une baisse de 50 points de base, qui, si elle est confirmée, pourrait réduire l'attrait de la monnaie.

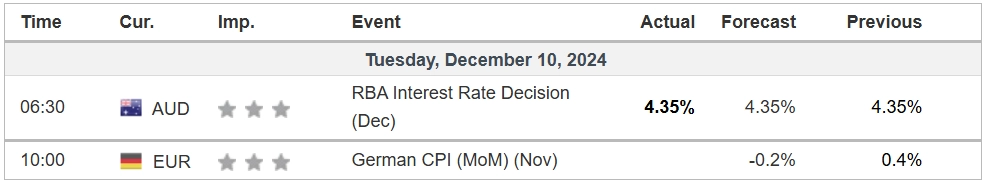

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 18 décembre Décision de la Fed sur les taux d'intérêt:

Source : Outil Fedwatch du CME

0 bps (40.4%) VS -25 bps (59.6%)

(Heure du système MT4)

Source : MQL5

Mouvements du marché

INDICE_DOLLAR, H4

The Dollar Index extended its gains as investors continued to digest robust US jobs data. Nonfarm Payrolls and the US Average Earnings Index + Bonus exceeded expectations. However, US CPI data, due later this week, remains the focal point for global investors. Though, gains experienced by the dollar are limited by downbeat analysts’ opinions. Morgan Stanley recently suggested the dollar’s momentum has slowed, raising the possibility of a technical correction.

L'indice du dollar se négocie à la hausse suite au rebond précédent depuis le niveau de support. Le MACD a illustré une dynamique haussière croissante, tandis que le RSI est à 54, ce qui suggère que l'indice pourrait prolonger ses gains depuis que le RSI a rebondi brusquement à partir d'un territoire survendu.

Niveau de résistance : 106,85, 108,05

Niveau de support : 105.80, 104.45

Les prix de l'or sont restés résistants, soutenus par les risques géopolitiques accrus à la suite de la chute du régime de Bashar al-Assad en Syrie. Au cours du week-end, Assad et sa famille se sont réfugiés à Moscou, mettant ainsi fin à cinq décennies de dictature. En outre, la Banque populaire de Chine (PBoC) a repris ses achats d'or après une interruption de six mois, apportant un soutien supplémentaire aux prix de l'or.

Les prix de l'or se négocient à la hausse suite à la rupture précédente au-dessus du niveau de résistance précédent. Le MACD a montré une dynamique haussière croissante, tandis que le RSI est à 59, ce qui suggère que le produit de base pourrait prolonger ses gains puisque le RSI reste au-dessus de la ligne médiane.

Niveau de résistance : 2655.00, 2705.00

Niveau de support : 2610.00, 2555.00

The GBP/USD pair continues to trade within its established uptrend channel but shows signs of waning upward momentum. The dollar’s renewed strength, bolstered by last Friday’s robust U.S. jobs report, has pressured the pair. The strong labor market data has heightened expectations of a more hawkish stance from the Federal Reserve, lending support to the greenback and challenging the pound’s recent gains.

La paire GBP/USD se négocie dans son canal haussier mais a formé un modèle de prix inférieur-haut, suggérant un renversement de tendance potentiel pour la paire. Le RSI reste au-dessus du niveau de 50 tandis que le MACD s'écoule au-dessus de la ligne de zéro, donnant un signal neutre pour la paire.

Niveau de résistance : 1,2790, 1,2850

Niveau de support : 1.2700, 1.2620

The EUR/USD pair briefly broke above the short-term resistance level at 1.0560 but failed to hold above this threshold, signaling a lack of bullish momentum. With the European Central Bank’s interest rate decision approaching, market speculation around a more significant rate cut is weighing on the euro’s strength. This dovish outlook has dampened sentiment and raised concerns about a potential trend reversal for the pair.

L'EUR/USD a formé un modèle de prix bas-haut, une cassure en dessous de la marque de 1,0530 sera un signal baissier pour la paire. Le RSI reste au dessus du niveau 50 tandis que le MACD reste au dessus de la ligne zéro, suggérant que la dynamique haussière reste intacte avec la paire.

Niveau de résistance : 1,0607, 1,0700

Niveau de support : 1.0440, 1.0325

The Japanese yen continued to slide against its peers, with the USD/JPY pair breaking above the short-term resistance level at 150.75, signaling a bullish bias. The market has lowered expectations for another rate hike from the Bank of Japan at its December 19th interest rate decision, adding to the yen’s weakness. In contrast, the dollar remains buoyed by robust U.S. job data released last week, which has reinforced the prospect of a hawkish Federal Reserve and provided additional upward momentum for the pair.

La paire USD/JPY a dépassé le niveau de résistance à court terme et a formé un modèle de prix plus élevé, suggérant un signal haussier pour la paire. Le RSI a dépassé le niveau de 50 tandis que le MACD a dépassé la ligne de zéro, suggérant que la dynamique haussière est en train de se former.

Niveau de résistance : 151,80, 154,15

Niveau de support : 149.40, 146.45

Wall Street a légèrement baissé, les prises de bénéfices sur les valeurs technologiques ayant pesé sur les performances avant le rapport sur l'inflation. NVIDIA (NVDA) a chuté de 2,6% et de 0,6% après les heures d'ouverture sur les rapports d'une enquête antitrust chinoise, tandis qu'Oracle (ORCL) a plongé de 8% après la publication de ses résultats, citant la concurrence de Microsoft (MSFT) et d'Amazon (AMZN), ce qui soulève des inquiétudes sur les perspectives de l'IA.

Le Nasdaq est en baisse et teste actuellement le niveau de support. Le MACD a illustré une dynamique baissière croissante, tandis que le RSI est à 50, ce qui suggère que l'indice pourrait prolonger ses pertes depuis que le RSI s'est fortement retiré de la zone de surachat.

Niveau de résistance : 21955.00, 23100.00

Niveau de support : 21170.00, 20395.00

Crude oil prices rebounded on escalating geopolitical tensions following the overthrow of Syrian President Bashar al-Assad. The regime’s collapse has raised concerns about potential regional conflicts that could disrupt oil supplies, driving up WTI prices. However, Saudi Arabia’s recent price cuts and extended OPEC+ output constraints continue to highlight weak demand fundamentals, particularly from China.

Les prix du pétrole se négocient à la hausse suite au rebond précédent depuis le niveau de soutien. Le MACD a montré une dynamique haussière croissante, tandis que le RSI est à 49, ce qui suggère que le produit de base pourrait étendre ses gains depuis que le RSI a rebondi de façon marquée à partir d'un territoire survendu.

Niveau de résistance : 70,40, 72,55

Niveau de support : 67.20, 65.65

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !