-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

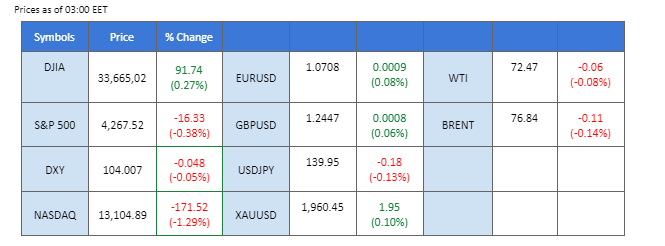

Malgré le risque de ralentissement économique en Australie, la RBA a surpris le marché en augmentant son taux d'intérêt de 25 points de base supplémentaires, s'engageant à ramener le taux d'inflation à 2%. La banque centrale canadienne a suivi l'exemple de la RBA et a ajouté 25 points de base à son taux d'intérêt, ce qui a entraîné la poursuite du renforcement du dollar canadien par rapport au dollar américain. Ces développements ont créé une pression sur les autres banques centrales pour qu'elles envisagent de relever leurs taux d'intérêt, en particulier la Réserve fédérale, qui avait initialement l'intention de suspendre les hausses de taux pour le mois en cours. En outre, les prix du pétrole ont enregistré un gain de 1% la nuit dernière, grâce à une baisse surprenante des stocks de pétrole brut aux États-Unis, ce qui indique une demande de pétrole brut supérieure aux prévisions.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 14 juin Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (66%) VS 25 bps (34%)

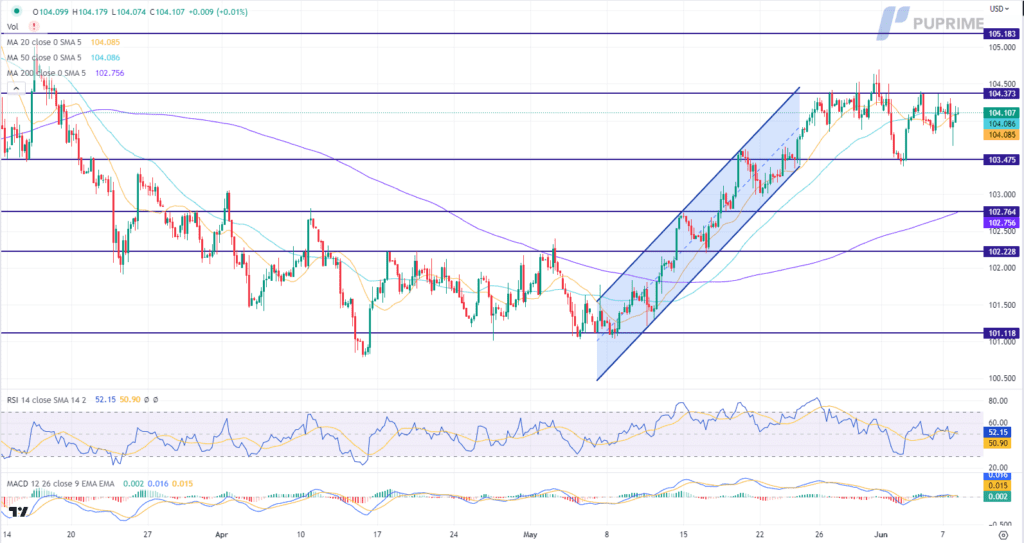

La hausse des rendements du Trésor américain à court terme a stimulé la demande du marché pour le dollar américain. Après la série de hausses de taux des banques centrales dans le monde entier, les investisseurs ont commencé à réévaluer la probabilité que la Réserve fédérale suive une voie similaire. En conséquence, les rendements des bons du Trésor à court terme aux États-Unis ont connu une hausse significative, atteignant 4,75%. Ce mouvement haussier suggère que les investisseurs institutionnels commencent à anticiper la possibilité que la Réserve fédérale relève les taux d'intérêt après sa réunion de politique générale de la semaine prochaine.

L'indice du dollar se négocie à la hausse alors qu'il est actuellement proche du niveau de résistance. Le MACD a illustré une dynamique haussière croissante, tandis que le RSI est à 52, suggérant que l'indice pourrait étendre ses gains après la rupture puisque le RSI reste au-dessus de la ligne médiane.

Niveau de résistance : 104,35, 105,20

Niveau de support : 103.45, 102.75

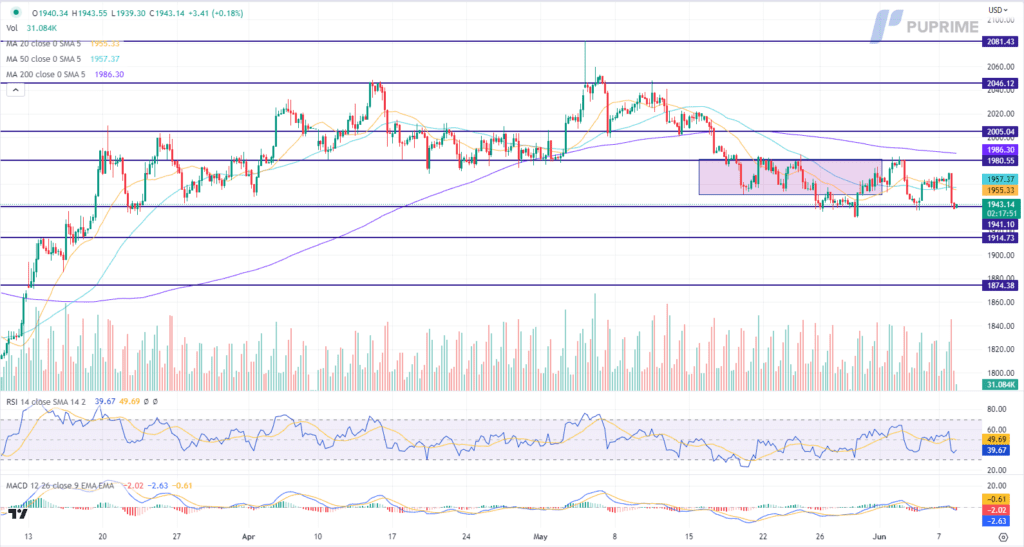

La réévaluation des attentes en matière de taux d'intérêt et l'évolution du sentiment du marché ont eu un impact sur le prix de l'or, entraînant une baisse de sa valeur. Les banques centrales telles que l'Australie et le Canada ayant relevé leurs taux d'intérêt, les investisseurs ont commencé à délaisser les matières premières à faible rendement comme l'or au profit d'actifs sûrs offrant des rendements sans risque plus élevés, tels que les obligations d'État.

Le prix de l'or est en baisse et teste actuellement le niveau de support. Le MACD a illustré une dynamique baissière croissante, tandis que le RSI est à 40, ce qui suggère que la marchandise pourrait étendre ses pertes après la rupture puisque le RSI reste en dessous de la ligne médiane.

Niveau de résistance : 1980.00, 2005.00

Niveau de support : 1940.00, 1915.00

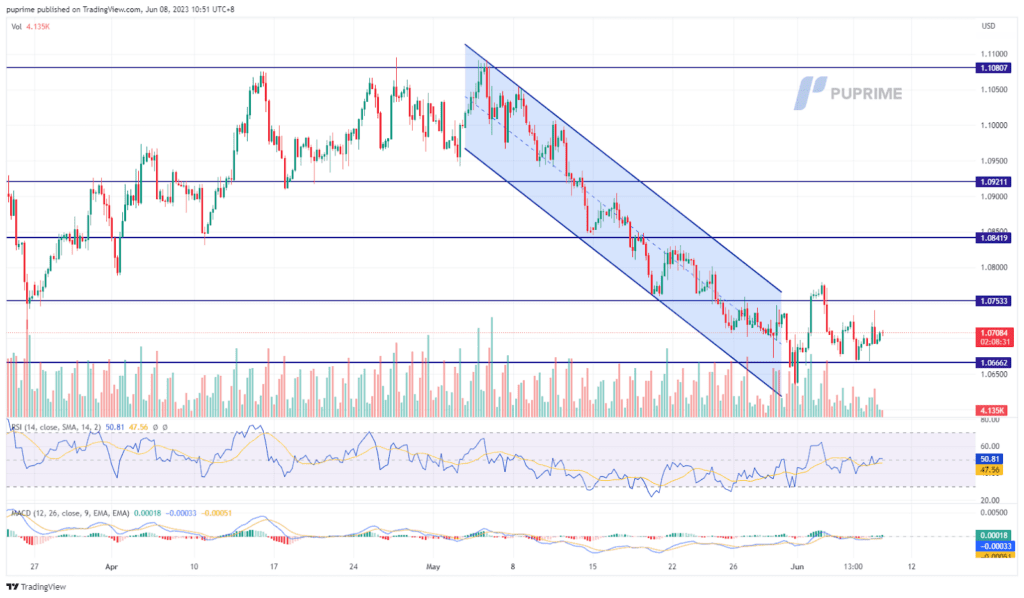

La paire continue de s'échanger dans une fourchette étroite, attendant un catalyseur pour stimuler le mouvement du prix de la paire. La semaine prochaine, les États-Unis annonceront leur indice des prix à la consommation (IPC), ce qui pourrait avoir un impact sur le dollar, même si la Fed prévoit de suspendre sa hausse des taux d'intérêt ce mois-ci. En outre, la BCE annoncera sa décision sur les taux d'intérêt la semaine prochaine, le marché étant largement convaincu que la BCE augmentera encore son taux d'intérêt de 25 points de base.

Le mouvement du prix de l'EUR/USD a été négocié entre 1,0723 et 1,067. La paire se négocie hors du canal baissier et le RSI a oscillé près du niveau 50 tandis que les flux MACD proches de la ligne zéro suggèrent un renversement de tendance pour la paire.

Niveau de résistance : 1,0753, 1,0840

Niveau de support : 1.0666, 1.0586

In a surprising move, the Bank of Canada raised its overnight interest rates by 25 basis points to 4.75%, reaching the highest level since 2001. This decision caught the market off guard, coming on the heels of Australia’s central bank’s announcement of its 12th rate hike in just over a year, defying expectations once again. The unexpected actions by these central banks have introduced a new dynamic to the global monetary landscape, challenging previous assumptions and prompting investors to reassess their outlook on interest rate trajectories.

L'USD/CAD se négocie à la baisse alors qu'il est actuellement proche du niveau de support. Le MACD a montré une diminution de la dynamique haussière. Cependant, le RSI est à 31, ce qui suggère que la paire pourrait entrer en territoire survendu.

Niveau de résistance : 1,3325, 1,3445

Niveau de support : 1.3325, 1.3270

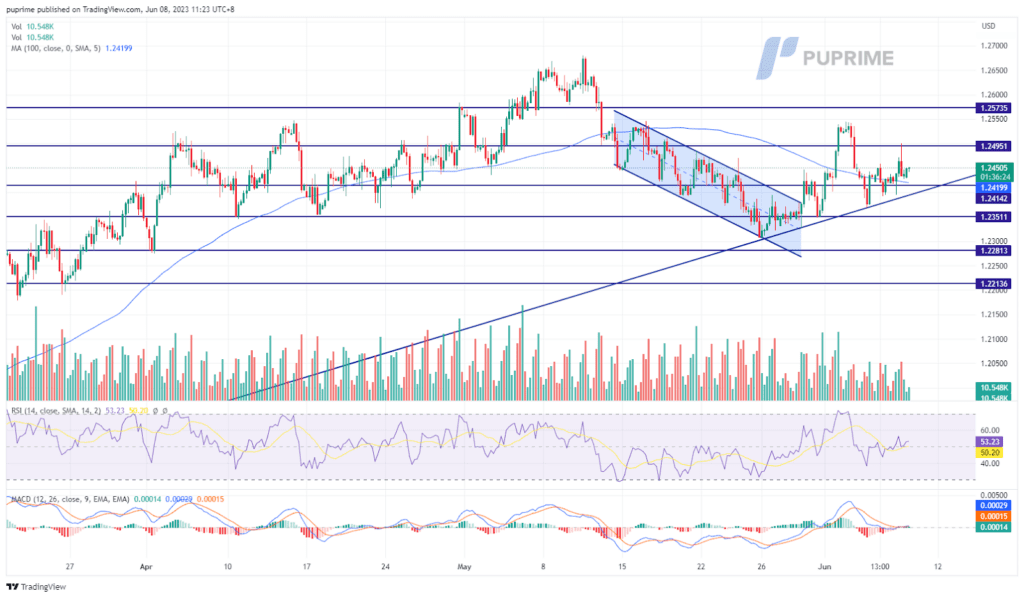

Cable continues to edge higher despite the USD having gained some strength, although the market is still uncertain of the following monetary moves from the Fed. The overall better-than-expected June economic data for the UK is convincing to speculate that the BoE will continue to raise its interest rate in June. The Fed will announce its interest rate next week while the BoE will announce the following week after the Fed’s announcement.

Le câble se négocie actuellement au-dessus de sa ligne de support de tendance haussière depuis son récent plus bas à la fin du mois de mai. Les indicateurs RSI et MACD indiquent actuellement une dynamique neutre.

Niveau de résistance : 1,2495, 1,2573

Niveau de support : 1.2414, 1.2350

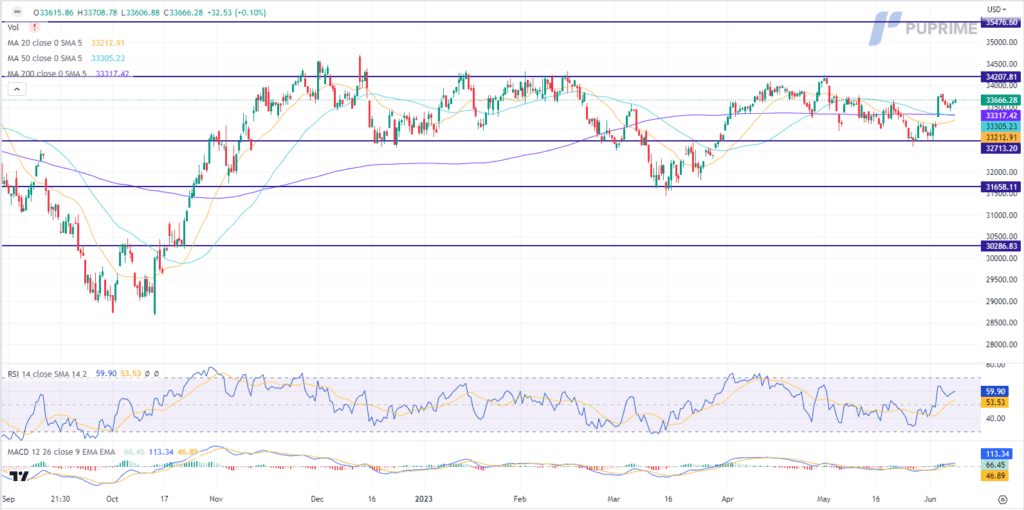

The Dow Jones Industrial Average struggled for direction yesterday as investors grappled with a mix of market sentiment and eagerly awaited updates from the Federal Reserve’s upcoming monetary meeting, as well as key inflation data. However, energy stocks emerged as the standout performers, driving broader market gains, as oil prices maintained their upward trajectory. This positive momentum in the energy sector was bolstered by Saudi Arabia’s recent move to reduce production and unexpected news on Wednesday revealing a decline in weekly US crude stockpiles. These developments injected optimism into the market, with investors closely monitoring the evolving dynamics of the oil market and their potential implications for broader economic trends.

Le Dow Jones se négocie à plat alors qu'il est actuellement proche du niveau de résistance. Le MACD a illustré une dynamique haussière croissante, tandis que le RSI est à 60, ce qui suggère que l'indice pourrait prolonger ses gains après une rupture réussie puisque le RSI reste au-dessus de la ligne médiane.

Niveau de résistance : 34207, 35476

Niveau de soutien : 32713, 31658

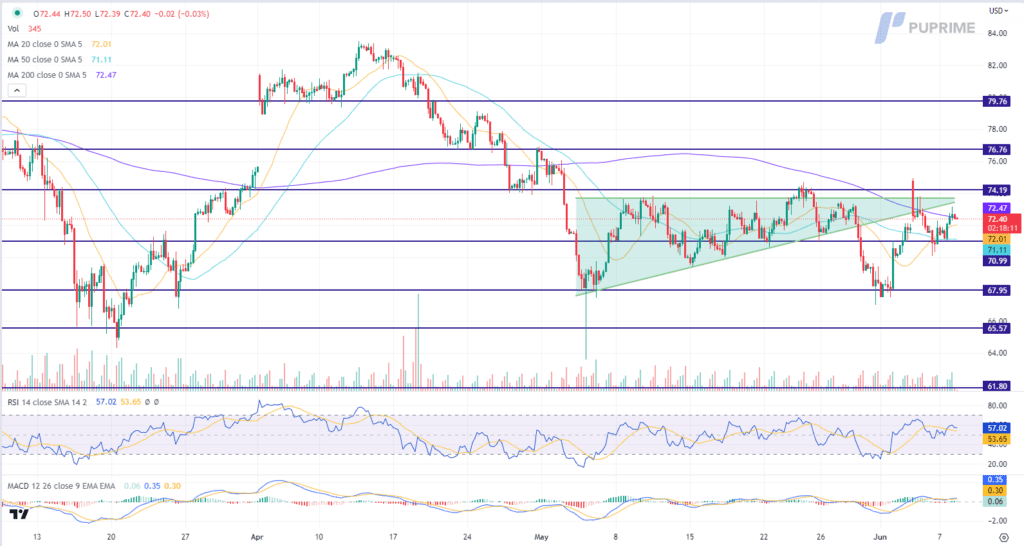

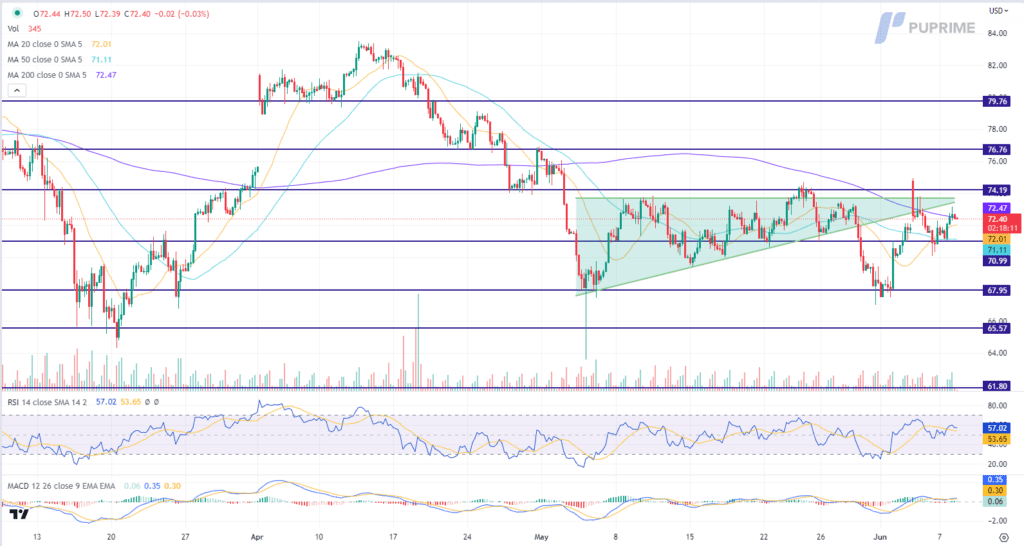

Les prix du pétrole restent enfermés dans une phase de consolidation, oscillant entre des niveaux de soutien et de résistance clés, alors que le sentiment du marché reste mitigé. Le sentiment négatif qui prévaut sur le marché du pétrole découle des préoccupations concernant les risques potentiels de récession et le cycle de resserrement en cours adopté par les banques centrales mondiales. Malgré ces vents contraires, le marché pétrolier a été stimulé par des données encourageantes sur les stocks, ce qui a donné une lueur d'espoir aux investisseurs. Les derniers chiffres de l'Energy Information Administration (EIA) ont révélé une baisse significative des stocks de pétrole brut aux États-Unis, passant de 4,488 millions de barils à -0,451 million de barils. Cette forte diminution des stocks a dépassé les attentes du marché qui tablait sur une baisse plus modeste de 1,022 million de barils.

Les prix du pétrole sont en baisse et testent actuellement le niveau de support. Le MACD a montré une diminution de la dynamique haussière, tandis que le RSI est à 53, ce qui suggère que le produit de base pourrait prolonger ses pertes après la rupture, puisque le RSI a fortement reculé depuis le territoire de surachat.

Niveau de résistance : 74,20, 76,75

Niveau de support : 71.00, 67.95

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !