-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

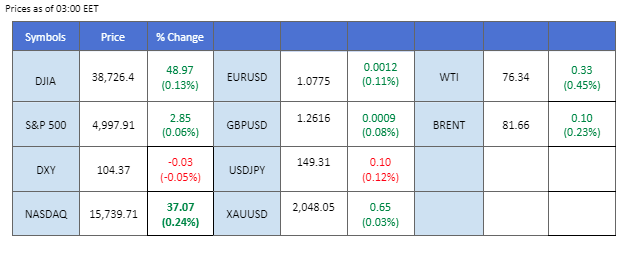

Oil prices surged by over 3% yesterday, driven by escalating tensions in the Middle East. Ceasefire talks took a gloomy turn as Israeli Prime Minister Benjamin Netanyahu rejected the Gaza deal, deeming it “delusional.” This geopolitical uncertainty in the Middle East also fueled demand for the safe-haven asset, gold. Meanwhile, the U.S. dollar maintained strength above the $104 level, supported by robust economic performance in the U.S. and consistent hawkish comments from various Fed officials. Additionally, BTC prices surpassed $45,000 for the first time since the SEC approved the BTC ETF. The initial “sell on news” sentiment waned, and demand for BlackRock and Fidelity ETFs bolstered the largest cryptocurrency.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 20 mars Décision de la Fed sur les taux d'intérêt:

Source : Outil Fedwatch du CME

0 bps (82%) VS -25 bps (18%)

(Heure du système MT4)

Source : MQL5

The Dollar Index maintains its position above the 104 level, signalling the continuity of bullish momentum. With increasing speculation that the Fed may sustain elevated interest rates for an extended period to curb inflation, the shift in market sentiment propelled the dollar to higher levels yesterday. The forthcoming economic data, particularly the Consumer Price Index (CPI) and Retail Sales figures, are anticipated to be crucial factors influencing the index’s price movements.

The Dollar Index remains trading at above 104 trajectories, suggesting a continued bullish bias for the index. The RSI remains hovering in the upper region while the MACD slides but is on the brink of crossing before breaking below the zero line, suggesting a bullish momentum may be forming.

Resistance level: 104.67, 105.70

Support level: 103.85, 103.20

Gold prices exhibited a wide range of fluctuations last night, responding to shifts in market sentiment. Initially impacted by a strengthened dollar amid a more hawkish outlook for the Fed’s monetary policy, gold experienced volatility. However, the dynamics changed with a reversal in the ceasefire talks related to Middle East tensions, leading to renewed demand for the safe-haven commodity.

Gold prices fluctuate widely but remain sideways and have not picked a direction. The RSI has been flowing near the 50 level while the MACD is hovering near the zero line, giving a neutral signal for the gold.

Resistance level: 2050.00, 2088.00

Support level: 2020.00, 1992.00

The GBP/USD lost its bullish momentum after experiencing a strong technical rebound from recent lows. The U.S. initial jobless claims, reported at 218k, came in lower than the previous reading, suggesting that the job market in the U.S. remains robust. This development fueled strength in the dollar and exerted pressure on the sterling.

GBPUSD is hovering near its crucial pivotal level at 1.2620 level, with wide fluctuation near such a level. The RSI gain from near the oversold zone while the MACD moves upward and approaches the zero line from below suggests a bullish momentum may be forming.

Niveau de résistance : 1,2710, 1,2785

Support level:1.2610, 1.2530

The EUR/USD struggled to maintain its position around the pivotal level of 1.0775. The growing monetary policy divergence between the ECB and the Fed is anticipated to exert strong downward pressure on the euro. The lacklustre economic performance in the eurozone has led to speculation that the ECB might consider an early rate cut to prevent a market recession, further softening the euro.

The EUR/USD sawawed in the last session and is currently trading near its crucial pivotal level at 1.0775. The MACD continue to gain and is approaching the zero line while the RSI rebounding to near the 50 level suggest a bullish momentum might be forming.

Niveau de résistance : 1,0866, 1,0954

Niveau de support : 1.0700, 1.0630

The US equity market continues its upward trajectory, although the bullish momentum appears to be easing in response to a shift in market sentiment. The latest economic indicators, particularly the job data, such as Initial Jobless Claims, suggest that the US job market remains resilient. This could influence the Federal Reserve to maintain the current elevated interest rate level for an extended period to address inflation concerns. A prolonged period of monetary tightening may pose challenges for the equity market to sustain higher gains.

Dow Jones is trading higher following the prior breakout above the resistance level. The RSI remains flowing in the upper region while the MACD hovers flat above the zero line, suggesting the index remains trading with strong bullish momentum.

Niveau de résistance : 39280.00, 40000.00

Support level: 37815.00, 36660.00

The USD/JPY pair has successfully breached its critical resistance level at 148.72, indicating a bullish bias for the pair. The Japanese Yen remains weak compared to other currencies, with the Japanese authorities facing a dilemma in shaping their upcoming monetary policy amidst subpar economic performance. Meanwhile, the US dollar continues to strengthen, fueled by positive economic data and hawkish comments from Federal Reserve officials.

The pair has broken above its strong resistance level at 148.72, suggesting a bullish signal for the pair. The RSI has broken into the overbought zone while the MACD crossed and moved upward, suggesting the bullish momentum is strong with the pair.

Resistance level: 151.80, 154.65

Support level: 148.72, 146.80

Crude oil prices exhibited strength despite a strengthened U.S. dollar, propelled by geopolitical uncertainty. Ceasefire discussions in the Middle East took a negative turn as the Israeli Prime Minister rejected the deal proposed by Hamas, deeming it delusional.

Oil prices are trading higher and have broken above their strong resistance level at near 75.2 levels, suggesting a bullish bias for oil prices. The RSI is on the brink of breaking into the overbought zone while the MACD has broken above the zero line and is diverging, suggesting the oil prices are trading with strong bullish momentum.

Resistance level: 78.60, 81.20

Niveau de support : 75.20, 71.35

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !