-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

Synthèse du marché

The Pound Sterling weakened following the Bank of England’s widely expected 25-basis-point rate cut yesterday, with GBP/JPY sliding to a two-month low. Market concerns over potential stagflation—characterized by high inflation and sluggish economic growth—further pressured Sterling. Meanwhile, the U.S. dollar faced resistance near the $108.00 mark after higher-than-expected Initial Jobless Claims data weighed on its strength. Traders now turn their attention to today’s Non-Farm Payrolls (NFP) report, which will be key in shaping expectations for the Federal Reserve’s next policy move and determining the dollar’s direction.

In contrast, the Japanese yen extended gains, supported by comments from a Bank of Japan official highlighting tight labor market conditions that have constrained business capacity. The central bank also signaled openness to further rate hikes, reinforcing the yen’s strength.

In the commodity market, oil prices remain under pressure, hitting new lows for 2025 as concerns over a potential trade war between the U.S. and China weigh on sentiment. Meanwhile, after a brief technical correction, gold has rebounded to its all-time high and could extend its rally if today’s NFP reading fails to provide a boost to the dollar.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 19 mars Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (100.0%) VS -25 bps (0%)

Aperçu du marché

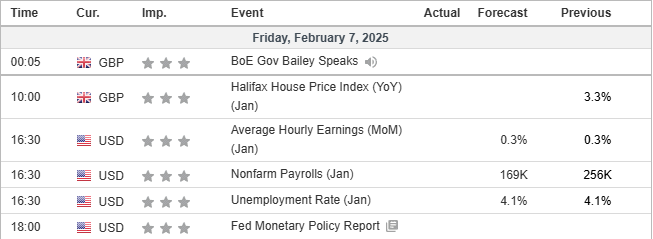

Calendrier économique

(Heure du système MT4)

Source : MQL5

Mouvements du marché

The Dollar Index (DXY) remained flat but tilted bearish as U.S.-China trade tensions escalated. China re-imposed tariffs on U.S. goods in a tit-for-tat move, yet no direct talks between President Trump and President Xi Jinping have been scheduled to de-escalate the situation. Trump stated that he was “in no hurry” to negotiate, adding to the market’s uncertainty. As trade concerns persisted, investors remained cautious about the dollar, awaiting further developments.

The Dollar Index is trading flat while currently near the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 40, suggesting the index might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 108.00, 108.75

Support level: 107.05, 106.15

Gold prices surged, extending their gains as risk-off sentiment deepened amid ongoing U.S.-China trade disputes. Additional geopolitical tensions in Gaza, where Trump’s intervention has added further complications, fueled the demand for safe-haven assets. Worse-than-expected U.S. jobless claims data also pressured the dollar, further supporting gold’s rally. However, with the U.S. Nonfarm Payrolls (NFP) and Unemployment Rate report set to be released later today, gold traders should monitor these data points for potential volatility.

Les prix de l'or se négocient à la hausse suite à la rupture précédente au-dessus du niveau de résistance précédent. Le MACD a montré une dynamique haussière croissante, tandis que le RSI est à 59, ce qui suggère que le produit de base pourrait prolonger ses gains puisque le RSI reste au-dessus de la ligne médiane.

Resistance level: 2885.00, 2895.00

Support level: 2860.00, 2840.00

The British pound (GBP) tumbled after the Bank of England (BoE) cut interest rates by 25 basis points to 4.5% from 4.75%, in line with expectations. However, the market reacted strongly to the fact that some BoE policymakers pushed for a larger rate cut to 4.25%, signaling growing concerns over economic growth. Catherine Mann, previously the most hawkish Monetary Policy Committee member, unexpectedly joined Swati Dhingra in advocating for deeper cuts. BoE Governor Andrew Bailey hinted at further rate reductions but maintained a cautious stance, stating that decisions will be made on a “meeting-by-meeting” basis.

GBP/USD is trading higher following the prior rebound from the support level. However, MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the pair might experience technical correction since the RSI stays below the midline.

Resistance level: 1.2485, 1.2610

Support level: 1.2375, 1.2305

EUR/USD found strong support at the 1.0350 level and rebounded, indicating that the pair remains on a bullish trajectory. The recent upside was primarily driven by a weaker U.S. dollar, which came under further pressure after Initial Jobless Claims exceeded market expectations, dampening the greenback’s strength. If today’s Non-Farm Payrolls (NFP) report fails to deliver a positive surprise, the dollar could extend its decline, further supporting the upward momentum in EUR/USD.

The EUR/USD pair has found its footing after a slight technical correction, suggesting a bullish bias. The RSI is sustained above the 50 level, while the MACD is supported above the zero line, suggesting that the pair remains trading with bullish momentum.

Resistance level: 1.0530, 1.0720

Support level: 1.0350, 1.0200

GBP/JPY hit a new low in the last session after breaking below the critical 1.0900 support level, signaling a bearish bias. The pair came under pressure following the Bank of England’s 25-bps rate cut, which weighed on market confidence in the U.K. economy and weakened the Pound Sterling. Additionally, demand for the safe-haven Japanese Yen surged amid heightened uncertainty, adding further downside pressure to the pair.

The GBP/JPY slid to a new low after breaking below its critical support level, suggesting a bearish bias for the pair. The RSI is poised to break into the oversold zone, while the MACD is edging lower and diverging, suggesting that the bearish momentum is gaining.

Resistance level: 190.00, 191.90

Support level: 187.80, 185.95

The Hang Seng Index has surged by approximately 4.65% this week, reaching a crucial resistance level at 21,200—a level that previously led to two rejections. The rally was driven by renewed confidence in China’s economy after Beijing signaled plans for larger economic stimulus in 2025. However, tensions remain high as China prepares retaliatory tariffs against the U.S. in response to trade policies introduced by the Trump administration. While stimulus measures have fueled optimism in Chinese equities, escalating trade frictions could introduce volatility in the coming sessions.

The Hang Seng index has gained sharply from its recent low level. However, it is facing strong resistance at the near 21200 mark. A break above this level would be a solid bullish signal for the index. The RSI has gotten into the overbought zone, while the MACD continues to edge higher after breaking above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 21850.00, 22700.00

Support level: 20450.00, 19670.00

Crude oil prices slipped, heading for a third consecutive weekly decline, as Trump’s trade tariffs on China and his commitment to boosting U.S. domestic oil production weighed on the market. The ongoing trade war has raised concerns over slowing global demand, with fears that tensions could extend to other countries. At the same time, Trump’s new sanctions targeting Iranian oil exports—affecting China, India, and the UAE—provided some bullish support, but were not enough to offset broader demand concerns.

Crude oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 72.70, 75.05

Support level: 70.45, 68.45

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !