-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

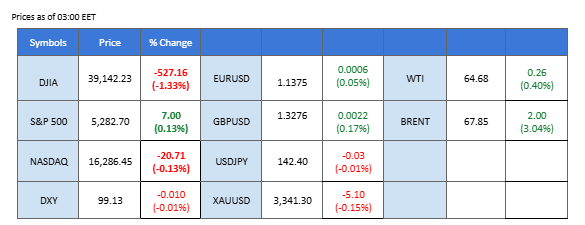

Market Summary

Markets were rattled this week as trade uncertainties and speculation over Fed Chair Jerome Powell’s potential replacement fueled investor caution. Gold soared, driven by stagflation concerns and growing doubts over the Fed’s policy direction. Powell’s warning that tariffs could stoke inflation clashed with Trump’s calls for more aggressive easing, prompting fears of leadership instability at the Fed.

The European Central Bank cut its deposit rate by 25bps to 2.25%, its seventh cut since June, as President Lagarde flagged global trade tensions as a major growth risk. While the rate move was expected, the euro remained steady, supported by signs of improving US-EU relations. Trump and Italian PM Meloni both expressed optimism over a potential trade deal, with Trump calling it “100%” certain.

Meanwhile, China reaffirmed its focus on Southeast Asia, with President Xi pushing for stronger ASEAN ties and upgraded trade protocols. Despite both Washington and Beijing signaling openness to broader talks, investors remain cautious, especially with the Good Friday holiday dampening market activity. US equities ended mixed, and the Dollar Index traded flat as sentiment stayed fragile.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (86%) VS -25 bps (14%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index traded flat, as markets adopted a wait-and-see approach ahead of the Good Friday holiday. Although both Washington and Beijing signaled openness to broader trade talks, investors remain cautious, awaiting concrete developments. Meanwhile, Powell’s warning that tariffs may stoke inflation clashed with Trump’s desire for more aggressive policy moves, leading to speculation over Powell’s potential dismissal. The resulting policy uncertainty continues to weigh on the dollar’s momentum.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 27, suggesting the index might enter oversold territory.

Resistance level: 101.95, 104.65

Support level: 99.40, 97.80

Gold prices continued their upward trajectory, hitting a new all-time high as investors sought refuge amid escalating geopolitical and economic turbulence. The rally reflects deepening concerns over a prolonged US-China trade conflict and rising stagflation risks. Market anxiety intensified following reports that President Trump is considering replacing Fed Chair Jerome Powell, frustrated with Powell’s cautious monetary stance. While no official action has been taken, the mere speculation has further clouded policy outlook, reinforcing gold’s appeal as a safe-haven asset.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 56, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 3350.00, 3380.00

Support level: 3290.00, 3220.00

The Australian dollar extended its rally that began on April 9, with the AUD/USD pair strengthening on the back of a weaker US dollar and growing concerns over the US economic outlook. President Trump’s latest comments that he does not wish to escalate tariffs further and that China has made “multiple overtures” bolstered hopes for a resolution. He added that a deal could potentially be reached in three to four weeks, offering some near-term support for risk-sensitive currencies like the Aussie. That said, trading activity remained muted heading into the holiday weekend.

AUD/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 63, suggesting the pair might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 0.6390, 0.6450

Support level: 0.6325, 0.6240

The European Central Bank (ECB) cut its deposit rate by 25bps to 2.25%, marking the seventh reduction since last June. President Christine Lagarde highlighted escalating global trade tensions as a primary threat to Eurozone growth. Despite the rate cut, the euro remained relatively stable, as the move was widely expected. Sentiment was slightly supported by optimism around US-EU trade talks, with President Trump and Italian PM Giorgia Meloni both expressing confidence in a potential deal. Trump even said a deal is “100% going to happen,” while Meloni emphasized the importance of Western unity. Her visit followed Trump’s decision to temporarily pause a planned 20% tariff on EU goods.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the pair might extended its gains since the RSI stays above the midline.

Resistance level: 1.1385, 1.1455

Support level: 1.1270, 1.1185

The US equity market closed mixed on Thursday, with the Dow Jones Industrial Average slipping 527 points (-1.3%), while the S&P 500 edged up 0.2% and the NASDAQ dipped 0.1%. The decline was driven by profit-taking ahead of the Good Friday holiday, as well as ongoing concerns about trade tariffs and economic uncertainty. Although both the US and China have signaled willingness to resume negotiations, investors remain cautious, choosing to monitor developments before making further commitments.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 40, suggesting the dow might extend its losses since the RSI stays below the midline.

Resistance level: 40595.00, 41830.00

Support level: 37925.00, 36305.00

The Japanese yen extended its gains, underpinned by expectations that the Bank of Japan will maintain current interest rates, in contrast to global easing trends. Positive momentum was also fueled by the recent progress in US-Japan trade negotiations, which were described as constructive by both sides. Coupled with waning demand for the US dollar amid rising economic pessimism, USD/JPY continues to face downside pressure.

USD/JPY is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the pair might enter oversold territory.

Resistance level: 143.95, 147.15

Support level: 139.75, 137.45

Crude oil prices surged over 3%, buoyed by renewed hopes for a US-EU trade agreement and escalating US sanctions on Iran, which threaten to constrain global supply. Optimism was fueled by the Trump-Meloni meeting in Washington, where both leaders voiced confidence in resolving transatlantic trade tensions. The fresh geopolitical developments have helped support oil prices despite broader economic concerns.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 64.45, 66.60

Support level: 62.00, 59.65

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!