-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

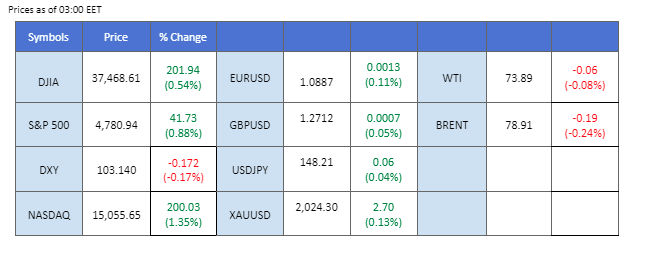

The U.S. economic data continues to underscore robust performance, contributing to the dollar’s strength. However, the greenback experiences a slight easing as the U.S. Congress approves funding for government spending, alleviating concerns about a potential government shutdown and reducing demand for the safe-haven currency. The improved sentiment fosters a risk-on environment, prompting a turnaround in the equity market, particularly for tech stocks that have faced recent bearish trends. In commodities, gold prices rebound on the back of a softer dollar, while the U.S. API crude inventories report reveals a significant decline, propelling oil prices to a more than 1.5% increase. Meanwhile, Japan’s latest inflation report falls short at 2.3%, below the previous reading, suggesting that the Bank of Japan may delay its plans to shift from its ultra-loose monetary policy.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 31 janvier Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (98%) VS -25 bps (2%)

(Heure du système MT4)

Source : MQL5

Mouvements du marché

INDICE_DOLLAR, H4

The Dollar Index maintained its upward trajectory, bolstered by yet another positive economic data release pointing to growth in the US economy. The Department of Labor’s report revealed a significant drop in US Initial Jobless Claims, declining by 16,000 to 187,000 for the week ending January 13, marking the lowest level since September 2022 and surpassing economists’ expectations of 207,000. A series of upbeat economic indicators coupled with a hawkish tone from Federal Reserve members has fueled heightened demand for the US Dollar in recent times.

L'indice du dollar se négocie à la hausse tout en testant actuellement le niveau de résistance. Cependant, le MACD a montré une diminution de la dynamique haussière, tandis que le RSI est à 59, ce qui suggère que l'indice pourrait subir une correction technique puisque le RSI a fortement reculé depuis le territoire de surachat.

Niveau de résistance : 103,40, 104,30

Niveau de support : 102.55, 101.90

Gold prices experienced a sharp rebound, recovering from the psychological level of $2,000, as escalating tensions in the Middle East fueled demand for the safe-haven asset. Despite the overall bullish trend for the US Dollar, it struggled to exert downward pressure on dollar-denominated gold. Rising military actions in the Middle East, particularly the US putting Yemen-based Houthi rebels back on its list of terrorist groups, underscored the geopolitical uncertainties propelling the demand for gold.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Niveau de résistance : 2035,00, 2055,00

Niveau de support : 2015.00, 1985.00

The Pound Sterling has demonstrated resilience and strength, gaining momentum in anticipation of the upcoming release of the UK’s Retail Sales figures. This positive trajectory follows the recent UK Consumer Price Index (CPI) data, which revealed that the nation’s inflation rate remains elevated. Market sentiment suggests that the Bank of England (BoE) might persist with its monetary tightening policy to address the persistent inflationary pressures.

GBP/USD pair continues to trade higher and is approaching its next resistance level at 1.2729. The RSI continue to move upward while the MACD is on the brink of breaking above the zero line, suggesting that bullish momentum is forming.

Niveau de résistance : 1,2729, 1,2815

Niveau de support : 1.2630, 1.2528

The EUR/USD pair has continued to trade with minimal volatility, experiencing a marginal gain as the U.S. dollar eased slightly in yesterday’s session. The U.S. Congress successfully passed a bill, securing funding for the government and averting a potential shutdown. This positive development contributed to a broader risk-on sentiment in the market, prompting a modest decline in the strength of the safe-haven U.S. dollar.

The EUR/USD pair traded sideways and is yet to provide a signal for both bullish or bearish trends. The MACD flowing flat below the zero line while the RSI hovering at the lower region gave a neutral signal for the pair as well.

Niveau de résistance : 1,0954, 1,1041

Niveau de support : 1.0866, 1.0775

The USD/JPY pair is currently trading at a flat level near its recent highs as the Japanese Yen continues to exhibit weakness against the U.S. dollar. In line with market expectations, the latest Japanese inflation report reveals a lower reading than the previous report. This suggests that Japan is facing challenges in achieving a sustainable inflation rate, hindering the potential for a monetary policy shift by the Bank of Japan (BoJ). The central bank may find it necessary to extend its wait before considering a move away from the current negative interest rate environment.

USD/JPY traded strongly and is heading to break another resistance level at 148.78. The RSI has been flowing within the overbought zone for a few sessions while the MACD has rebounded strongly, suggesting the bullish momentum is strong.

Niveau de résistance : 148,88, 151,83

Niveau de support : 146.90 145.35

The US equity market saw upward momentum as big tech staged a comeback, driven by a rally in Apple and positive performance in chip stocks. Apple surged over 4% following an upgrade from Bank of America, citing optimism about the demand for the latest hardware to support artificial intelligence features on iPhones. The semiconductor industry also received a bullish boost, with major companies delivering upbeat quarterly results that surpassed Wall Street estimates.

The Dow is trading higher while currently nearby the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 52, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Niveau de résistance : 37850.00, 39275.00

Niveau de support : 36735.00, 35950.00

Crude oil prices witnessed continued gains, driven by a larger-than-expected drawdown in US crude inventories and easing concerns regarding the demand outlook. The Energy Information Administration reported a sharp decline of 2.5 million barrels in US crude oil inventories, surpassing market expectations of a 331,000-barrel draw. Optimistic forecasts from OPEC+ and the International Energy Agency further contributed to the positive sentiment, with the IEA anticipating oil market demand to grow by 1.24 million barrels per day in 2024, up 180,000 from its previous projections.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Niveau de résistance : 74,00, 78,65

Niveau de support : 70.25, 67.40

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !