-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

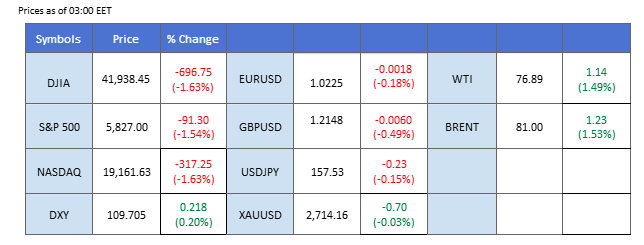

Synthèse du marché

The U.S. Nonfarm Payrolls report last Friday exceeded expectations at 256k, with unemployment improving to 4.1%. These data points reinforced expectations that the Fed may adopt a more cautious stance while extending its rate cut path, providing strength to the U.S. dollar. However, Wall Street faced significant losses, with all three major indices plunging to new lows, reflecting investor concerns about the impact of prolonged high interest rates.

Gold prices rallied toward the $2,700 mark as demand for the safe-haven asset rose due to uncertainties surrounding Trump’s administration and geopolitical developments in the Middle East and Eastern Europe, which could further fuel the precious metal’s prices. Oil also saw a sharp rally, climbing to a four-month high as U.S. sanctions on Russian crude supported bullish momentum. In contrast, BTC and ETH prices remained subdued amid a lack of catalysts, reflecting broader risk-off sentiment in the crypto market.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 29 janvier Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (93.1%) VS -25 bps (6.9%)

(Heure du système MT4)

N/A

Source : MQL5

Mouvements du marché

INDICE_DOLLAR, H4

The Dollar Index extended its gains following a stronger-than-expected US jobs report, with Nonfarm Payrolls rising to 256K (vs. 164K expected) and unemployment dropping to 4.10% (vs. 4.20% expected). The upbeat data fueled expectations that the Federal Reserve may keep interest rates elevated, driving Treasury yields to their highest levels in 2023. This reinforced the dollar’s strength as investors adjusted their monetary policy outlook.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 71, suggesting the index might experience technical correction since the RSI might enter overbought territory.

Resistance level: 109.90, 111.60

Support level: 107.65, 105.75

Gold initially dipped following the strong US jobs data but quickly regained ground, driven by safe-haven demand amid growing trade and geopolitical uncertainties. Despite the positive employment figures, gold’s resilience remains intact as investors seek protection from potential risks. If gold holds above the 2670.00 support level, it may continue to attract safe-haven buying, particularly amid ongoing global tensions.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 55, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 2690.00, 2720.00

Support level: 2665.00, 2635.00

The GBP/USD pair dropped to a fresh low, driven by the U.S. dollar’s robust strength and the absence of significant catalysts supporting the Pound Sterling. The dollar’s rally was underpinned by stronger-than-expected U.S. Nonfarm Payroll data and an improved unemployment rate, reinforcing expectations of a more hawkish monetary policy approach by the Federal Reserve in the near term. Meanwhile, the lack of positive developments for the UK economy has left the Pound vulnerable to further downside pressure. With the pair now trading at its lowest level since November 2022, it signals a clear bearish bias, and traders will likely monitor upcoming U.S. and UK economic data for potential directional cues.

The pair has gotten to new lows, suggesting a bearish bias for the pair. The RSI has dropped into the oversold zone while the MACD continues to edge lower, indicating that the bearish momentum is gaining.

Resistance level: 1.2220, 1.2310

Support level: 1.2140, 1.2060

The GBP/USD pair dropped to a fresh low, driven by the U.S. dollar’s robust strength and the absence of significant catalysts supporting the Pound Sterling. The dollar’s rally was underpinned by stronger-than-expected U.S. Nonfarm Payroll data and an improved unemployment rate, reinforcing expectations of a more hawkish monetary policy approach by the Federal Reserve in the near term. Meanwhile, the lack of positive developments for the UK economy has left the Pound vulnerable to further downside pressure. With the pair now trading at its lowest level since November 2022, it signals a clear bearish bias, and traders will likely monitor upcoming U.S. and UK economic data for potential directional cues.

The pair has broken below its price consolidation range and has approached its 2-year low level, suggesting a bearish bias for the pair. The RSI has reached the oversold zone, while the MACD continues to edge lower at below the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 1.0330, 1.0458

Support level: 1.0112, 1.0001

The USD/JPY pair has been trading in a relatively sideways pattern for over three weeks, reflecting a lack of clear directional momentum as traders await hints regarding the Bank of Japan’s (BoJ) interest rate decision ahead of its announcement on January 25th. Despite the U.S. dollar’s broad-based strength against its peers last Friday, the pair’s muted reaction suggests that the Japanese Yen has effectively absorbed the dollar’s gains. This resilience in the Yen could signal an impending trend reversal for the pair, especially if the BoJ adopts a more hawkish tone or implements measures that bolster the Yen further.

The USD/JPY has been sideways for more than 3 weeks after a bullish rally, suggesting that the bullish momentum has eased and potentially will have a trend reversal for the pair. The RSI and MACD have been flowing flat, which is in line with the view of a limited bullish momentum with the pair.

Resistance level: 159.15, 160.50

Support level: 157.15, 156.00

US equities tumbled as investors processed the strong jobs data, which raised concerns that the Federal Reserve may maintain higher rates for longer. With the 10-year Treasury yield (^TNX) climbing toward 4.8%, the outlook for the equity market grew dimmer, especially given the pressure from higher borrowing costs. The market is now navigating between robust economic data and the potential for prolonged higher rates.

Nasdaq is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 21200.00, 21820.00

Support level: 20755.00, 20395.00

Oil prices surged to a three-month high, propelled by the US imposing sanctions on Russian oil producers, which are expected to disrupt global supply chains. The move is likely to escalate supply concerns, particularly in major importing countries like China and India. Speculation regarding China’s potential economic stimulus further boosted oil prices, as demand expectations rose alongside tightening supply.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is t 74, suggesting the commodity might enter overbought territory.

Resistance level: 78.00, 83.75

Support level: 72.95, 66.85

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !