-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

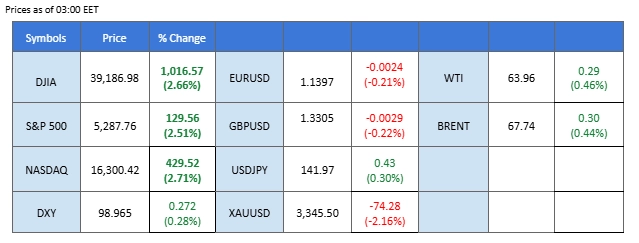

Market Summary

U.S. equities rebounded sharply in the last session, with Wall Street recovering most of its previous losses, after President Trump made remarks aimed at soothing market anxieties. The U.S. dollar also gained traction, with the Dollar Index (DXY) climbing back above the 99.00 mark, reflecting renewed investor confidence.

Markets reacted positively after Trump clarified that he has no intention of firing Federal Reserve Chair Jerome Powell, a move that had previously spooked investors and raised concerns over the Fed’s independence. Trump further bolstered sentiment by stating he is committed to de-escalating tensions with China, signaling a potential shift from his confrontational trade stance.

This dovish pivot eased global risk aversion, leading to a sharp pullback in safe-haven assets. Gold prices plunged to near $3,300, while traditional haven currencies like the Japanese Yen and Swiss Franc weakened modestly, although they continue to trade at elevated levels amid lingering geopolitical and economic uncertainties.

Looking ahead, today’s key PMI releases from the UK, eurozone, and the U.S. will be closely watched. These data points are expected to offer fresh insights into the health of the global economy and could act as short-term catalysts for respective currency pairs, especially if they surprise the upside or downside. Market volatility is likely to remain elevated as traders weigh data-driven signals against the ongoing political and policy backdrop.

Current rate hike bets on 7th May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (90.9%) VS -25 bps (9.1%)

Market Overview

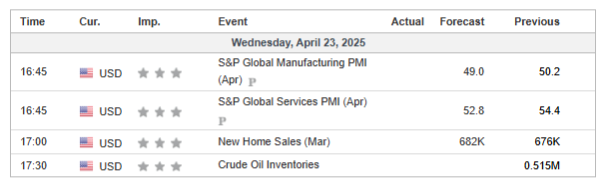

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index rebounded slightly as investors regained confidence following a more positive tone from the US on both trade talks and Fed independence. Trump clarified he has “no intention of firing” Fed Chair Powell, easing concerns over political interference. Meanwhile, hopes for a partial tariff rollback in US-China negotiations and comments from Treasury Secretary Bessent pointing to a near-term de-escalation helped lift market sentiment and risk appetite.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 100.15, 102.95

Support level: 97.15, 95.85

Gold prices pulled back from record highs as investors booked profits amid a broader shift toward risk-on sentiment. The precious metal had previously surged on fears surrounding trade tensions and political interference in monetary policy. However, with renewed optimism over trade talks and political clarity in the US, gold saw short-term selling pressure. Still, unresolved concerns — such as the Fed’s rate path and ongoing geopolitical issues — could reignite demand for gold.

Gold prices are trading lower while currently testing the upward trendline. MACD has illustrated increasing bearish momentum, while RSI is at 50, suggesting the commodity might extend its losses after breakout since the RSI retreated from overbought territory.

Resistance level: 3385.00, 3430.00

Support level: 3355.00, 3295.00

The GBP/USD pair dipped into a key fair-value gap (FVG) zone in the last session but found solid support before breaching through, indicating the pair is still trading within a bullish structure. This technical behavior underscores underlying demand for the Pound, even as the U.S. dollar regained some strength. The greenback rebounded following comments from President Trump, who clarified that he has no plans to remove Fed Chair Jerome Powell, a move that helped stabilize market sentiment and lift the dollar broadly. Looking ahead, traders will closely monitor the UK’s PMI data, due later today. A strong reading could reinforce expectations of economic resilience and provide fresh bullish momentum for Sterling, potentially pushing GBP/USD back toward recent highs.

The pair incurred a minor technical retracement but remains trading within its bullish trajectory. The RSI has slid out from the overbought zone, while the MACD has a deadly cross on the above, suggesting that the bullish momentum is easing.

Resistance level: 1.3340, 1.3420

Support level: 1.3270, 1.3185

The EUR/USD pair broke below its recent low, indicating a renewed bearish bias amid a strengthening U.S. dollar. The greenback regained footing after President Trump’s positive rhetoric, including reassurance about maintaining Fed leadership and easing trade tensions with China, which boosted overall market sentiment and supported the dollar. Meanwhile, the euro faces downside pressure ahead of the release of key PMI data from Germany and the broader eurozone. Market expectations suggest a potential softening in activity, and if confirmed, the data could further undermine the euro, reinforcing the bearish outlook for EUR/USD.

The pair has a structural break, suggesting a bearish bias. The RSI has broken below the 50 level, while the MACD has a lower-high pattern, suggesting that the bullish momentum is diminishing and is in line with the bearish view.

Resistance level: 1.1468, 1.1623

Support level: 1.1340, 1.1200

The Dow Jones sharply, jumping 2.66%, as trade de-escalation hopes and strong corporate earnings lifted sentiment. Treasury Secretary Bessent’s comments hinting at lower U.S.-China tariffs helped ease investor anxiety, while upbeat results from 3M and Tesla added to the risk-on mood. Despite the rally, the index remains below its 21-day moving average, signaling lingering caution. Defense stocks came under pressure amid tariff uncertainty, and macro risks persist following the IMF’s downgrade of U.S. growth to 1.8%. Political tension over the Fed’s independence, following Trump’s criticism of Powell, continues to inject volatility into the broader equity narrative.

Dow Jones remains constrained below key resistance at 40,595, despite a recent bounce from support near 37,923. Technical indicators reinforce the indecisive tone as the RSI at 45 remains neutral, while the MACD lingers below its signal line, confirming weak momentum.

Resistance level: 40595.00, 41830.00

Support level: 37923.00, 36305.00

USD/JPY rebounded from easing political pressure on the Fed and renewed U.S.-China trade optimism lifted risk sentiment. President Trump’s assurance that Powell won’t be removed calmed market nerves, while Treasury Secretary Bessent’s tariff comments boosted the dollar during Asian trading. However, gains were limited by persistent Fed rate cut expectations—three 25bps cuts are still priced in. Meanwhile, the yen remains supported by safe-haven demand and steady domestic fundamentals. Japan’s April PMI showed continued manufacturing weakness (48.5) but services improved (52.2), and with core CPI steady at 2.2%, the BoJ is expected to stay hawkish. Slow progress in the U.S.-Japan trade talks adds further yen support.

USD/JPY is trading higher while currently testing the resistance level near 143.95. MACD has illustrated increasing bullish momentum and offering an early bullish divergence, while RSI is at 53, suggesting the pair might extend its rebound as the RSI climbs above the midline from oversold territory, indicating a potential shift in sentiment.

Resistance level: 143.95, 147.15

Support level: 140.45, 137.45

Oil prices are trading within a higher-high price pattern, signaling bullish momentum, though currently facing a strong resistance at the $64.00 level. A confirmed break above this key threshold would solidify the bullish outlook, potentially opening the door for further upside. The recent rebound in oil was driven by renewed optimism surrounding the U.S.-China trade tensions, after President Trump and the U.S. Treasury Secretary both expressed confidence in a potential de-escalation of the tariff standoff. This shift in tone has improved market sentiment and helped lift the demand outlook for oil, which had been under pressure from geopolitical and economic uncertainties.

Oil prices have been gaining for the past two weeks after dipping to their lowest level since 2021. A break above the critical resistance level at the $64.00 mark should be a key bullish signal for oil. The RSI has been gaining toward the overbought zone, while the MACD has broken above the zero line, suggesting that the oil price is trading with bullish momentum.

Resistance level: 66.60, 69.75

Support level: 62.00, 59.57

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!