-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

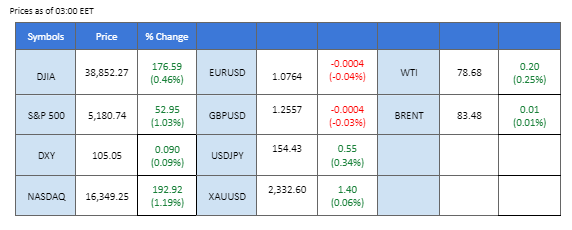

The U.S. equity market continued its upward trajectory, buoyed by growing optimism surrounding potential interest rate cuts by the Federal Reserve later this year, following the release of softer-than-expected nonfarm payroll data last Friday, indicating a slowdown in economic performance. Japan’s Nikkei 225 index surged over 1% this morning upon returning from Monday’s holiday. However, the yen weakened after Japan’s top currency official stated that government intervention would not be necessary if the market was functioning properly.

In the commodity markets, gold prices faced resistance at the $2330 level, while oil prices saw marginal gains. The ongoing truce talks between Israel and Hamas are being closely monitored, while anticipated oil supply cuts from Iraq and Kazakhstan are expected to bolster oil prices.

Additionally, Bitcoin (BTC) experienced a notable 10% surge since last Thursday, reaching above the $63,000 mark. The GrayScale Bitcoin Trust (GBTC) recorded a net inflow to the fund for the first time in May, signaling positive sentiment in the crypto market and increased investor interest in cryptocurrencies.

Les paris actuels sur la hausse des taux d'intérêt se poursuivent 12 juin Décision sur les taux d'intérêt de la Fed:

Source : Outil Fedwatch du CME

0 bps (91.6%) VS -25 bps (8.4%)

(Heure du système MT4)

Source : MQL5

INDICE_DOLLAR, H4

The Dollar Index continued its downward trajectory as bleak job reports fueled expectations of rate cuts by the Federal Reserve. Richmond Fed President Thomas Barkin suggested that current interest rates should suffice to stabilise inflation at the central bank’s 2% target, hinting at potential rate cuts if economic data deteriorates further. Meanwhile, Federal Reserve Bank of New York President John Williams acknowledged the possibility of rate cuts in the future but emphasised the current stability of monetary policy.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated increasing bullish momentum, while RSI isa t 41, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Niveau de résistance : 105,70, 106,35

Niveau de support : 105.05, 104.60

Gold prices saw a rebound driven by rising Middle East tensions, signalling a shift in sentiment towards safe-haven assets. However, hopes for an immediate ceasefire in the Gaza Strip were dashed as Israel’s war cabinet rejected the proposed deal, further fueling demand for dollar-denominated gold amid uncertainties surrounding the US jobs report and potential Fed rate cuts.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 59, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2330.00, 2350.00

Support level: 2310.00, 2290.00

The GBP/USD pair exhibited a sideways trading pattern in the previous session as traders anticipated the upcoming Bank of England (BoE) interest rate decision on Thursday. The dollar’s decline has tempered somewhat following its initial drop, triggered by the softer-than-expected U.S. job data released last Friday. With recent indications that the UK’s CPI is moderating, market focus is intensively directed towards the BoE’s monetary policy statement, also due on Thursday, which is expected to provide further insights into the potential trajectory of the Sterling.

The GBP/USD was resisted at near 1.2600 while the bullish momentum is lacking. The RSI has failed to break into the overbought zone, while the MACD flowing flat at close to the zero line suggests the bullish momentum is easing.

Niveau de résistance : 1,2660, 1,2760

Niveau de support : 1.2440, 1.2370

The EUR/USD pair is currently trading just below the key psychological resistance level of 1.0800, with investors looking for a catalyst to propel it above this threshold. Market participants are keenly awaiting the release of the Eurozone’s retail sales figures later today, which are anticipated to show positive growth. Should the data surpass market expectations, it could serve as the needed catalyst to drive the pair higher, potentially breaching the 1.0800 resistance level.

La paire est rejetée en dessous de 1,0800, attendant un élan haussier suffisant pour dépasser ce niveau. Le MACD et le RSI ont légèrement augmenté, suggérant que la paire continue à se négocier avec une dynamique haussière.

Niveau de résistance : 1,0865, 1,0955

Niveau de support : 1.0700, 1.0630

The US equity market extended gains on revived expectations of Fed rate cuts in September, leading to bullish sentiment on Wall Street. Traders are increasingly betting on rate cuts as soon as September, with Fed officials indicating a shift towards easing monetary policy in light of slowing job growth. Richmond Fed President Richard Barkin noted that while current policy is restrictive, recent data has cast doubt on the pace at which the central bank can bring inflation down to its target. New York Fed President John Williams warned of eventual rate cuts but expressed concern over unexpected upside surprises in inflation data.

Dow Jones is trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 39145.00, 39855.00

Support level: 37690.00, 36550.00

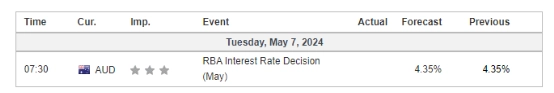

The AUD/USD pair is presently trading near its monthly high, poised for potential movement following the upcoming Reserve Bank of Australia (RBA) interest rate decision scheduled for later today. Market sentiment suggests expectations for the RBA to maintain its hawkish stance on monetary policy, particularly in light of persistent inflationary pressure. This anticipation has served as a bullish catalyst for the Australian dollar in recent sessions. Traders will closely monitor the central bank’s decision and accompanying statement for insights into future monetary policy direction, which could influence the direction of the AUD/USD pair.

AUD/USD is currently holding below 0.6640, awaiting the crucial RBA’s announcement. The RSI remains elevated, while the MACD continues to edge higher, suggesting that bullish momentum remains.

Niveau de résistance : 0,6640, 0,6680

Niveau de support : 0.6585, 0.6540

Oil prices stabilised around support levels amid renewed Middle East tensions, with Israeli Prime Minister Benjamin Netanyahu’s dismissal of a ceasefire proposal dealing a blow to hopes for a resolution in Gaza. Investors are advised to monitor developments in Middle Eastern countries for trading signals.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bullish momentum, while RSI is at 42, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Niveau de résistance : 80,40, 81,90

Niveau de support : 78.00, 75.95

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de dispositifs acceptés.

Accédez à des centaines d'instruments avec les meilleures conditions de trading.

Veuillez noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Veuillez noter que PU Prime et ses entités affiliées ne sont ni établies ni actives dans votre juridiction nationale.

En cliquant sur le bouton "Accuser réception", vous confirmez que vous accédez à ce site web uniquement de votre propre initiative et non à la suite d'une démarche commerciale spécifique. Vous souhaitez obtenir des informations à partir de ce site web, qui sont fournies sur la base d'une sollicitation inversée, conformément aux lois en vigueur dans votre pays.

Merci de votre reconnaissance !

Il convient de noter que le site web est destiné aux personnes résidant dans des juridictions où l'accès au site web est autorisé par la loi.

Tenez compte du fait que PU Prime et ses entités affiliées ne sont pas établies et n'opèrent pas dans votre juridiction d'origine.

En cliquant sur le bouton "Accepter", vous confirmez que vous entrez sur ce site web de votre propre initiative et non à la suite d'un quelconque effort de marketing spécifique. Vous souhaitez obtenir des informations sur ce site web qui sont fournies par le biais d'une demande inversée conformément aux lois de votre juridiction d'origine.

Merci de votre reconnaissance !