-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

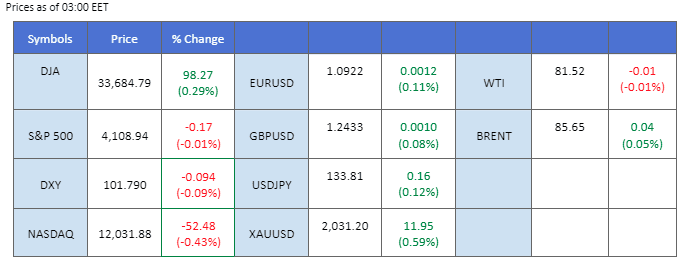

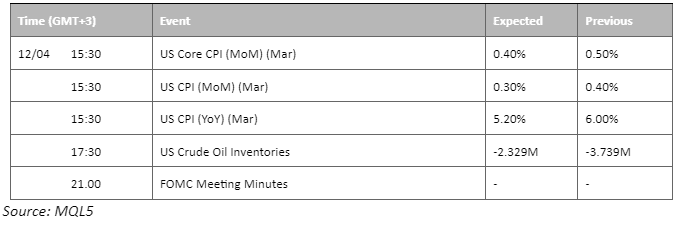

U.S. equity markets have traded in low volatility for the past few sessions, but economists project the lull period will be broken after the U.S. CPI is released later today. A softer reading from the CPI is likely to bolster the equity markets and impact the dollar as it will be more convincing to the market that inflation in the U.S. is easing. Meanwhile, Fed officials have divided opinions, with some advocating for a pause and leaving the Fed rate at 5% while others are still determined to bring the inflation rate down to 2%. On the other hand, oil prices traded slightly higher at above $81 before the IEA and OPEC+ monthly reports are released later this week. Oil market foreseeably will remain tight with China’s growing demand and the OPEC+ supply cut.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (33%) VS 25 bps (67%)

In anticipation of pivotal inflation data released from the US region, the greenback experienced a dip as investors strategically repositioned their assets to brace for potential turbulence. Economists anticipate that the March Consumer Price Data, released on Wednesday, could show that headline inflation rose by 0.20% while core inflation rose 0.40%. The recent slew of mixed economic data has only added to the uncertainties surrounding the US economic outlook. Despite most of the manufacturing data failing to meet market expectations, the strong jobs data for March have instilled confidence in market players, leading many to expect the US central bank to hike rates again in May.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the index might extend its losses after breakout since the RSI retreated sharply from the overbought territory.

Resistance level: 102.80, 103.40

Support level: 101.95, 101.45

The price of gold has steadfastly maintained its position, trading flat as it continues to linger perilously close to the critical resistance level of $2,000. Market participants are acutely attuned to the release of the US Consumer Price Index, eagerly awaiting this data to inform their assessment of potential monetary policy adjustments by the Federal Reserve. In the interim, investors remain attuned to global economic events and closely monitor market developments to identify any indications that could trigger a notable shift in gold prices.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 53, suggesting the commodity might extend its gains after its successful breakout since the RSI stays above the midline.

Resistance level: 2005.00, 2030.00

Support level: 1980.00, 1950.00

The euro edged higher against the dollar while the dollar has lost its bullish momentum ahead of CPI data released. The dollar eased from its technical rebound as the market expects a softer reading from the CPI and believes the Fed may pause its rate hike in May. The previously released U.S. economic data, including PMI and NFP, indicated a slowdown in the inflation rate in the country and the market expecting an end to the monetary tightening policy with the worry of recession. A weakening dollar may boost the euro to trade higher as the ECB has been relatively hawkish as compared to the Fed.

There are signs of building up in bullish momentum for the pair as the RSI is moving upward slowly while the MACD has rebounded from the zero line.

Resistance level: 1.0917, 1.1055

Support level: 1.0867, 1.0796

The Canadian dollar (CAD) has experienced a substantial surge in value due to rising oil prices, the commodities that Canada heavily relies on for export revenue. As a result of these higher oil prices, Canada’s export profits have risen, driving up demand for the Canadian dollar. Despite this positive news, the pair of USD/CAD now hangs in the balance as investors await the release of the US Consumer Price Index data later Wednesday. This highly anticipated data could significantly impact the strength of USD/CAD, and investors are keeping a close eye on any potential market-moving developments.

USD/CAD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the pair might extend its losses after successfully breakout since the RSI stays below the midline.

Resistance level: 1.3555, 1.3655

Support level: 1.3445, 1.3325

As risk sentiment improved, the pound rose slightly by 0.18% to $1.2428 on Tuesday. Moreover, the Bank of England is not hosting a policy meeting until next month, but Governor Andrew Bailey is ready to speak today, and it might give clues on the future path. Meanwhile, U.S. CPI data is due today and will impact the pound’s value. As for now, traders are pricing in a 75% chance of a 25 basis point hike in May, with around a 25% chance the central bank keeps the rate unchanged. Investors are advised to wait for more economic data for further trading signals.

Furthermore, investors are advised to focus on the upcoming CPI data for further trading clues. MACD is hovering on the zero line, indicating a neutral momentum. RSI is at 52, suggesting a neutral momentum as well.

Resistance level: 1.2425, 1.2613

Support level: 1.2298, 1.2190

The Dow Jones Industrial Average remained unchanged in early trading, as investors eagerly awaited the release of crucial inflation data and the unofficial start of the first-quarter reporting season. With future monetary policy decisions from the Federal Reserve being heavily dependent on data, market participants are closely monitoring the release of the Consumer Price Index (CPI) later today, in search of any evidence that the long and gradual cooling of inflation is continuing.

The Dow is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 34265.00, 35770.00

Support level: 32650.00, 31435.00

Oil prices rose above $81 per barrel, driven by a general risk-on sentiment and boosted by the first supply-and-demand projections for the week, which predicted a modest rise in US production. It has contributed to a positive market outlook, leading to higher oil prices. In addition, Russian seaborne oil exports dropped significantly last week. Flows from Russian ports have declined by 1.24 million barrels a day, which is the largest weekly drop since December, when storms hit two export ports. It could tighten the global oil market supply, prompting oil prices up.

Oil prices edged higher and were testing the resistance level. Investors are looking forward to CPI data which is due today. MACD has illustrated neutral-bullish momentum ahead. RSI is at 66, indicating the pair is trading within neutral-bullish momentum.

Resistance level: 85.45, 90.04

Support level: 81.06, 77.25

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!