-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

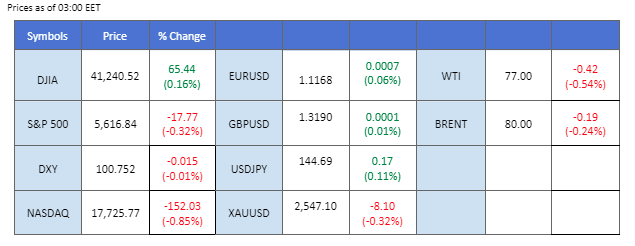

Market Summary

Geopolitical tensions in both the Middle East and Eastern Europe have escalated, creating significant unease in the broader financial markets. Adding to the uncertainty, market participants are positioning for a potential September Fed rate cut, which seems increasingly likely. In response to the geopolitical uncertainty, oil prices surged nearly 3% in yesterday’s session. Meanwhile, gold, a traditional safe-haven asset, saw its strength ease as it approached its recent high. U.S. Treasuries remained stable, and the dollar found support after hitting its lowest level in 2024.

On Wall Street, the equity market lacked clear direction, with traders focusing on Nvidia’s earnings report due on Wednesday. As a bellwether for the tech industry, Nvidia’s performance is expected to have a significant impact on the direction of the U.S. equity market, particularly the tech-heavy Nasdaq index.

In the cryptocurrency market, despite a technical retracement in yesterday’s session, the outlook for Bitcoin (BTC) remains positive. The market sentiment is bolstered by a net inflow of $500 million into crypto ETFs last week and the dovish tone from Jerome Powell’s speech on Friday, which has fueled optimism among crypto investors.

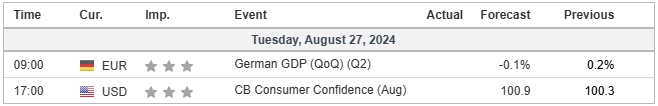

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index saw a slight rebound yesterday, primarily driven by bargain buying and technical correction after hitting a crucial support level. However, the long-term trend for the dollar remains tilted toward a bearish outlook, influenced by expectations of rate cuts from the Federal Reserve. Not only has Fed Chair Jerome Powell vowed to reduce interest rates in September, but San Francisco Fed President Mary Daly also reiterated her belief that it is appropriate for the US central bank to begin cutting rates. Daly emphasised that the Fed has made progress in bringing inflation down to its target.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 20, suggesting the index might enter oversold territory.

Resistance level: 102.35, 103.35

Support level: 100.90, 99.80

Gold’s overall outlook remains positive, supported by rising geopolitical tensions in the Middle East and declining US Treasury yields. Although gold prices experienced a short-term retracement after nearly reaching a record high of $2,530, this was largely due to profit-taking ahead of several crucial events scheduled for later this week. Investors are now focusing on the upcoming US Core PCE Price Index report to gauge further trading signals and the potential impact on gold prices.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2525.00, 2535.00

Support level: 2505.00, 2480.00

The GBP/USD pair has eased in strength following a seven-session rally, indicating a potential pause in its upward momentum. The U.S. dollar appears to have found some support after hitting its lowest level in 2024, suggesting that selling pressure may be subsiding for now. With both currencies currently lacking fresh catalysts, traders are looking ahead to Friday’s U.S. Personal Consumption Expenditures (PCE) reading, a key inflation gauge favoured by the Federal Reserve. The PCE data is expected to have a direct impact on the dollar, potentially influencing the GBP/USD pair’s direction in the near term.

GBP/USD is expected to fill the gap to near 1.3150 before the pair continues to surge. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting the pair overall remains trading with bullish momentum.

Resistance level: 1.3280, 1.3350

Support level: 1.3140, 1.3065

The EUR/USD pair has eased slightly in recent sessions but remains within its bullish trajectory, indicating that the overall upward trend is still intact. This week, traders are closely watching the upcoming inflation data releases from both the Eurozone and the U.S., with the Eurozone CPI and U.S. PCE scheduled for release on Friday. These key inflation indicators could provide fresh direction for the pair, as they will offer insights into the respective central banks’ future monetary policy moves.

EUR/USD remains trading in an uptrend. However, the MACD has given a bearish divergence signal, suggesting a potential trend reversal for the pair. Should the pair fail to defend at above 1.1115, it may be a solid trend reversal signal.

Resistance level: 1.1230, 1.1290

Support level: 1.1106, 1.1045

The AUD/USD pair remains at its recent peak levels, awaiting a catalyst to break through its next resistance level. The release of the RBA monetary meeting minutes last week revealed a hawkish stance from the Australian central bank, which has been bolstering the strength of the Aussie dollar in recent sessions.

The pair is hovering near its recent high, and the bullish momentum seems to be diminishing. The RSI remains above 50, but the MACD has formed a lower high and has a bearish cross, suggesting that the bullish momentum is easing with the pair.

Resistance level: 0.6845, 0.6921

Support level: 0.6730, 0.6670

The US tech sector experienced some selloff as investors rotated toward other growth stocks ahead of key financial reports from major tech corporations due later this week. Nvidia’s upcoming earnings report is expected to be a significant highlight for the overall tech sector. Meanwhile, cyclical sectors, including financials, which hit 52-week highs on Monday, rallied on expectations that these stocks could benefit significantly from anticipated rate cuts.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 56, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 20015.00, 20705.00

Support level: 19035.00, 17865.00

Crude oil prices extended their gains sharply after Libya’s eastern government declared force majeure—a legal clause allowing producers to miss shipments—on all oil fields, terminals, and facilities. This move has heightened fears of significant supply disruptions, as the eastern government seeks to compete with its Tripoli-based rival for control over the OPEC member’s central bank and oil wealth. Additionally, rising geopolitical tensions between Israel and the Iran-backed Hezbollah over the weekend have further fueled concerns about supply disruptions, providing additional support for oil prices.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the commodity might enter overbought territory.

Resistance level: 78.55, 80.90

Support level: 75.45, 73.60

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!