Tag Archives: Intermediate

Types of Bonds: Understanding Your Options for Fixed-Income Investments

Whether you’re a beginner exploring fixed-income investments, or an experienced investor looking to diversify your portfolio, this guide offers valuable insights into bonds, their benefits, and how to navigate the bond market effectively. What are Bonds? Bonds are a cornerstone of the financial markets, offering a dependable way for investors to generate steady income andContinue Reading

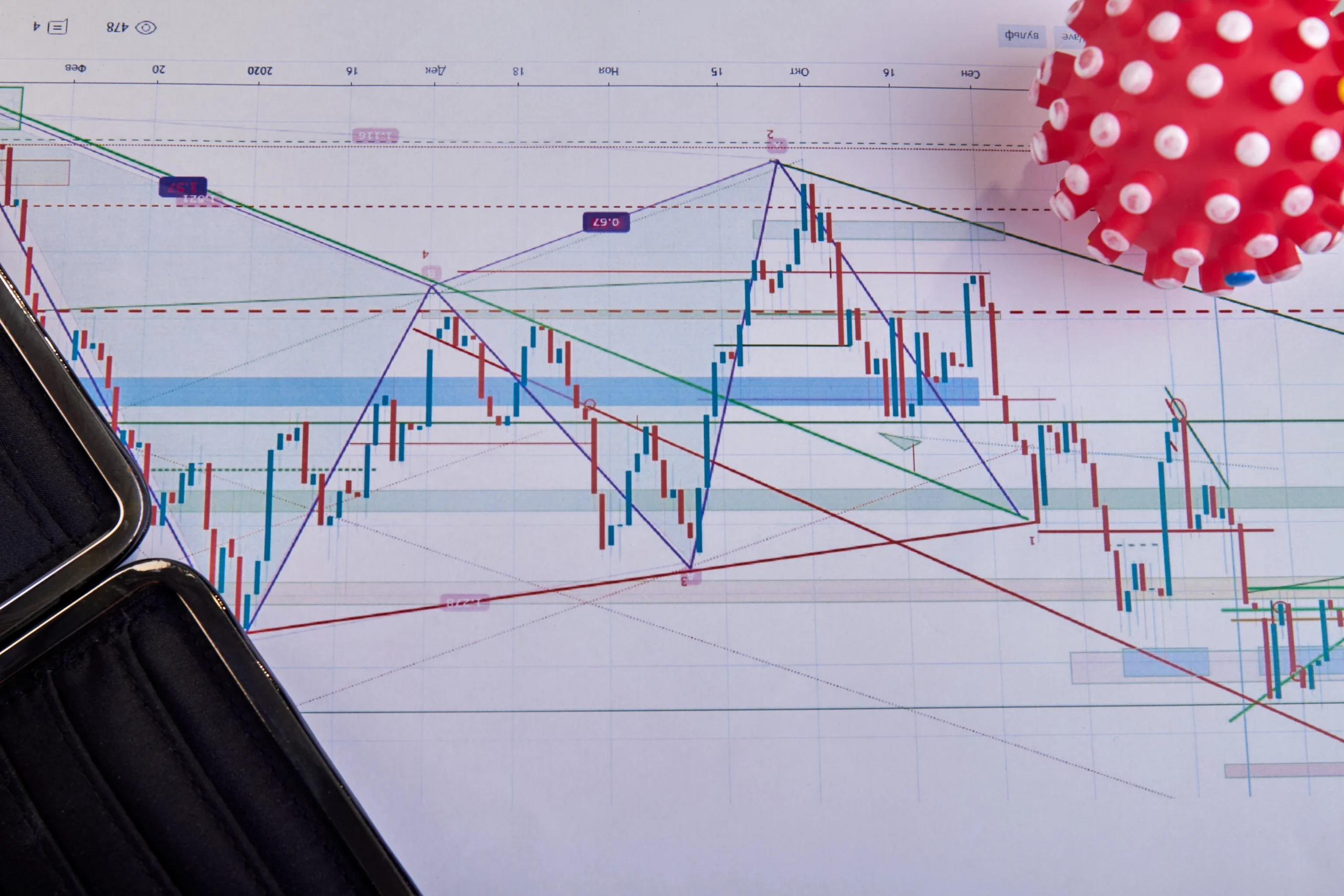

Reverse Hammer Candlestick: A Key Reversal Signal in Trading

An Inverted Hammer candlestick is one of the most famous charting tools in technical analysis. It is used to identify a potential reversal pattern from bearish to bullish. This trend may occur after a downtrend or a corrective phase within an uptrend, which suggests that selling pressure may slowly decrease and a shift towards upwardContinue Reading

Understanding the Head and Shoulders Pattern in Trading

In the dynamic world of trading, recognising patterns is crucial for predicting market movements. The head and shoulders pattern is a formation used in technical analysis to identify potential market reversals. The head and shoulders chart pattern serves as a reliable indicator that an upward trend may be nearing its end, signaling traders to anticipateContinue Reading