-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

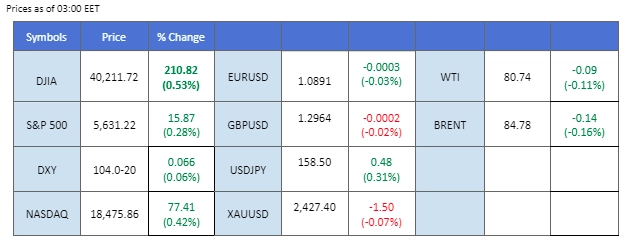

As we step into the earnings report season, the U.S. equity market rallied, with the Dow Jones climbing to its highest point in the last session, gaining over 200 points. The aftermath of Donald Trump’s shooting incident has influenced the equity market, compounded by a dovish statement from Jerome Powell indicating that inflation is trending towards the 2% target, as shown by the second-quarter economic data. Despite geopolitical issues in the country, the safe-haven dollar has been hindered by the Fed’s dovish stance.

Gold took advantage of the softened dollar, reaching its highest level in two months at $2,439.75 before retracing. Meanwhile, oil prices are under pressure due to pessimistic Chinese economic data. Traders should keep an eye on today’s U.S. Retail Sales reading, which could impact the dollar’s strength, while positioning themselves for tomorrow’s UK and Eurozone CPI readings.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.3%) VS -25 bps (6.7%)

(MT4 System Time)

Source: MQL5

The Dollar Index, which tracks the US dollar against a basket of six major currencies, extended its losses after Fed Chair Jerome Powell suggested that recent downbeat inflation readings have increased the Fed’s confidence in bringing down inflation. This hints that the Fed is moving closer to rate cuts. However, Powell did not provide any guidance on the timing of interest rate moves, stating that decisions will be made on a meeting-by-meeting basis. With the recent slowdown in inflation and a stable labor market, investors will focus on the FOMC interest rates meeting in two weeks for further trading signals.

The dollar index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 41, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 104.45, 104.75

Support level: 104.05, 103.65

Gold prices extended their gains, buoyed by risk-off sentiment in the global market ahead of the US Presidential elections. Following the recent assassination attempt on Trump, investors remain concerned that the election could increase uncertainties. Additionally, the recent slowdown in US inflation has increased the odds of the Fed easing its monetary policy further, supporting dollar-denominated gold.

Gold prices are trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 2430.00, 2445.00

Support level: 2410.00, 2400.00

The GBP/USD pair faced strong resistance just below the 1.3000 level and is currently awaiting a catalyst to break above this psychological barrier. The geopolitical uncertainty in the U.S., following a gun-shooting incident at Donald Trump’s presidential election campaign in Pennsylvania, has created volatility. However, the dollar remains lacklustre, with market participants closely watching today’s Retail Sales reading, which could significantly impact the dollar’s strength.

The GBP/USD is currently facing resistance near the 1.3000 level and has traded sideways over the past few sessions. The RSI has dropped out from the overbought zone while the MACD has crossed on the above, suggesting the bullish momentum is easing.

Resistance level: 1.3000, 1.3065

Support level: 1.2940, 1.2850

The EUR/USD pair traded sideways at its recent high, with profit-taking sentiment weighing on the pair whenever it hit above the 1.0900 level. The Fed Chair’s dovish statement yesterday, expressing confidence that inflation is heading down to the 2% target rate, has hindered the dollar’s strength and provided buoyancy for the pair.

EUR/USD stood pat in the last session at its recent high level, and the bullish momentum seemed to be easing. The RSI has dropped out from the overbought zone, while the MACD formed a double top and has crossed on the above, suggesting that the bullish momentum is easing.

Resistance level: 1.0940, 1.0985

Support level: 1.0853, 1.0816

The Dow surged by more than 200 points in the last session, reaching an all-time high of 40,358.00. The assassination attempt on Trump during his presidential campaign had a positive effect on the market, as the leading candidate is believed to bolster market confidence. Additionally, the dovish statement from the Fed Chair yesterday has further fueled the upward momentum for the equity market.

The Dow remained trading with strong bullish momentum and stayed at its all-time high levels, suggesting a bullish signal for the index. The RSI remained in the overbought zone, while the MACD continued to edge higher, suggesting that the bullish momentum remained strong.

Resistance level: 40380.00, 40600.00

Support level: 40000.00, 39800.00

The USD/JPY is strongly supported above the 157.30 level and has begun to rebound, indicating a bullish bias for the pair. The dollar regained strength in the last session due to geopolitical uncertainty, while strong selling pressure on the Japanese yen presents a challenge for Japanese authorities in safeguarding their lacklustre currency. Meanwhile, Friday’s Japan National Core CPI is highly anticipated as it could be a pivotal point for the pair’s direction.

The pair has rebounded from its strong support level at near 158.00, suggesting a potential trend reversal signal. The RSI has surged above the oversold zone, while the MACD has crossed at the bottom, suggesting the bearish momentum is vanishing.

Resistance level: 159.80, 160.50

Support level:157.90, 157.30

Crude oil prices eased slightly, weighed down by downbeat economic data from China, the top importer. The latest GDP reports indicated that China’s economy grew much slower than expected in the second quarter due to a protracted property downturn and job insecurity. China’s refinery output fell by 3.70% in June from a year earlier, marking the third consecutive month of decline due to planned maintenance and lacklustre fuel demand. Nonetheless, the losses in the oil market are still limited by rising Middle East tensions and OPEC’s efforts to stabilise oil prices.

Oil prices are trading lower following retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 83.75, 86.65

Support level: 81.10, 78.00

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!