-

- Plateformes de trading

- Application PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Conditions de Trading

- Types de compte

- Spreads, Coûts et Swaps

- Dépôts et Retraits

- Frais et Charges

- Heures de Trading

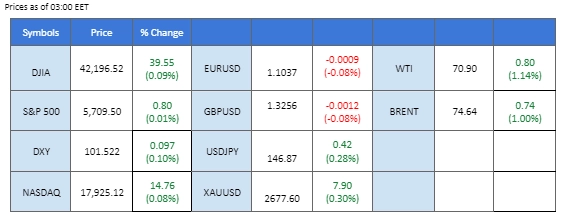

Market Summary

Hong Kong’s stock rally paused in today’s session after the Chinese index surged by over 30% from its September lows. The equity market is now facing profit-taking pressure, with the Hang Seng Index down nearly 3% as of writing.

In contrast, Japan’s Nikkei 225 jumped at the market’s open, driven by a surprise statement from new Prime Minister Ishiba, who expressed caution about another rate hike this year, citing the economy’s unpreparedness. This dovish outlook fueled gains in Japanese equities. However, the Japanese Yen weakened considerably in the last session, sliding more than 2% against a strengthened U.S. dollar.

The U.S. dollar gained momentum after the ADP job data exceeded market expectations, signalling continued labour market strength. However, strong U.S. jobs data weighed on Wall Street, with all three major indexes trading flat amid concerns about potential Fed tightening.

In the commodity market, gold was pressured by the strengthening dollar, leading the precious metal to trade sideways, despite escalating Middle East tensions. Oil prices initially surged on supply concerns stemming from the conflict, but a surprise build in U.S. crude inventories led to a sharp decline in prices, leaving oil traders cautious.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32%) VS -25 bps (68%)

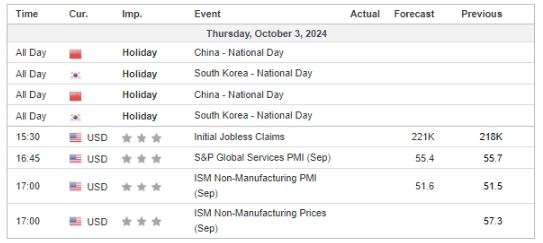

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index surged, rebounding sharply due to strong economic data and hawkish statements from Federal Reserve Chair Jerome Powell. ADP’s Nonfarm Employment Change rose from 103K to 143K, surpassing expectations of 124K. Economists anticipate that the upcoming nonfarm payroll report will show a steady labor market, with 140,000 jobs added and the unemployment rate holding at 4.2%. These positive indicators reduced expectations for a 50-basis point rate cut by the Fed in the upcoming meeting.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 77, suggesting the index might enter overbought territory.

Resistance level: 101.80, 102.35

Support level: 100.95, 100.30

Gold prices rebounded slightly as geopolitical tensions in the Middle East spurred demand for safe-haven assets. The ongoing conflict, particularly the missile strikes between Iran and Israel, has led investors to shift their focus toward gold. However, gains were limited due to strong U.S. economic data, particularly the better-than-expected ADP Nonfarm Employment report. Investors are maintaining a cautious stance ahead of Friday’s Nonfarm Payroll and Unemployment rate data, which could further impact gold’s movement.

Gold prices are trading flat while currently consolidating in a zone. MACD has illustrated diminishing bullish momentum, while RSI is at 52, suggesting the commodity might edge lower since the RSI retreated sharply from overbought territory .

Resistance level: 2670.00, 2685.00

Support level: 2645.00, 2630.00

The GBP/USD pair has broken to a new low after breaching its previous fair-value gap, signalling a bearish bias. The U.S. dollar strengthened, buoyed by stronger-than-expected ADP nonfarm employment change data, which drove the Dollar Index (DXY) to a 3-week high. Looking ahead, both the U.K. and U.S. will release PMI readings later today, which are expected to be pivotal in shaping the pair’s movement. Strong PMI data from the U.S. could further support the dollar, while any surprises from the U.K. data may provide support for the Pound Sterling.

The GBP/USD is on the brink of breaking below from its current price consolidation range suggesting a bearish signal for the pair. The RSI is approaching the oversold zone while the MACD continues to edge lower, suggesting the bearish momentum is forming.

Resistance level: 1.3280, 1.3350

Support level: 1.3220, 1.3140

The EUR/USD pair continues to slide, approaching its lowest level from last month at 1.1005. The recent release of the eurozone unemployment rate, which matched market expectations at 6.4%, combined with the CPI reading that came in below 2%, has fueled speculation that the ECB may implement another rate cut soon to address the region’s lacklustre economic performance. This prospect has weighed on the euro’s strength, contributing to the pair’s ongoing decline.

The pair has slid for the past four sessions and remains trading within its bearish trajectory. The RSI is close to breaking into the oversold zone, while the MACD continues to edge lower, suggesting that the bearish momentum is gaining.

Resistance level: 1.1085, 1.1150

Support level: 1.1020, 1.0950

The USD/JPY pair surged to its highest level in a month following a surprise speech by Japan’s new Prime Minister, Shigeru Ishiba, last night. Ishiba indicated that the country is not ready for another rate hike, erasing market expectations of a potential BoJ rate hike by the end of 2024. This dovish stance from Japan’s leadership contributed to the yen’s weakness. Meanwhile, the strengthening U.S. dollar, supported by robust economic data, further bolstered the pair, driving it to its recent high.

The pair recorded its biggest single-day gain since September by more than 2%, suggesting it is currently trading with strong bullish momentum. The RSI has gotten into the overbought zone, while the MACD has broken above the zero line and is diverging, suggesting the bullish momentum is gaining.

Resistance level: 149.20, 151.75

Support level: 146.00, 143.45

The U.S. equity market saw modest gains, buoyed by continued expectations for future rate cuts and the resilience of the U.S. economy. Despite the positive outlook, the market remains flat, with investors adopting a wait-and-see approach due to the ongoing Middle East conflict and the upcoming Nonfarm Payroll report. Several individual stocks faced significant losses during the quarterly earnings season. Tesla stock dropped over 3% after underwhelming vehicle delivery numbers, and Nike fell by more than 6% after posting a 10% revenue slump and withdrawing its full-year financial forecast.

Dow Jones is trading flat while currently testing the support level. However, MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 42990.00, 44000.00

Support level: 41965.00, 40700.00

Ethereum (ETH) has broken below two key support levels this week, indicating that the cryptocurrency is under strong downside pressure. The recent release of upbeat U.S. job data has further strengthened the U.S. dollar, suggesting that the Federal Reserve may delay its next rate cut. This has contributed to the selling pressure on ETH. Additionally, the escalating geopolitical tensions in the Middle East have worsened market sentiment, leading to a retreat from risky assets, including cryptocurrencies like Ethereum.

ETH has dropped by more than 10% since the beginning of the week, suggesting a bearish bias for ETH. The RSI remains in the oversold zone, while the MACD continues to edge lower, suggesting that bearish momentum is gaining.

Resistance level: 2420.00, 2565.00

Support level: 2340.00, 2240.00

Oil prices extended their gains amid escalating Middle East tensions, driven by Iran’s missile attacks on Israel, marking a serious escalation in the region’s conflict. Investors are closely monitoring the situation for potential retaliatory actions from Israel, which could further disrupt oil supplies. However, oil price gains were tempered by an unexpected rise in U.S. crude inventories, which increased by 3.9 million barrels, easing some concerns over supply disruptions.

Oil prices are trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 71.90, 74.15

Support level: 70.30, 68.60

Tradez le Forex, les indices, Métaux et plus encore avec des spreads faibles et une exécution ultra-rapide.

Inscrivez-vous pour un compte réel PU Prime grâce à notre procédure simplifiée.

Approvisionnez facilement votre compte grâce à un large éventail de canaux et de devises acceptées.

Accédez à des centaines d’instruments avec les meilleures conditions de trading.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!